USD/JPY Signal Update

Last Thursday’s signal expired without being triggered as the price never reached 120.26.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 118.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the first test of 119.44.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the first retest of the bearish trend line currently located at around 119.95.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

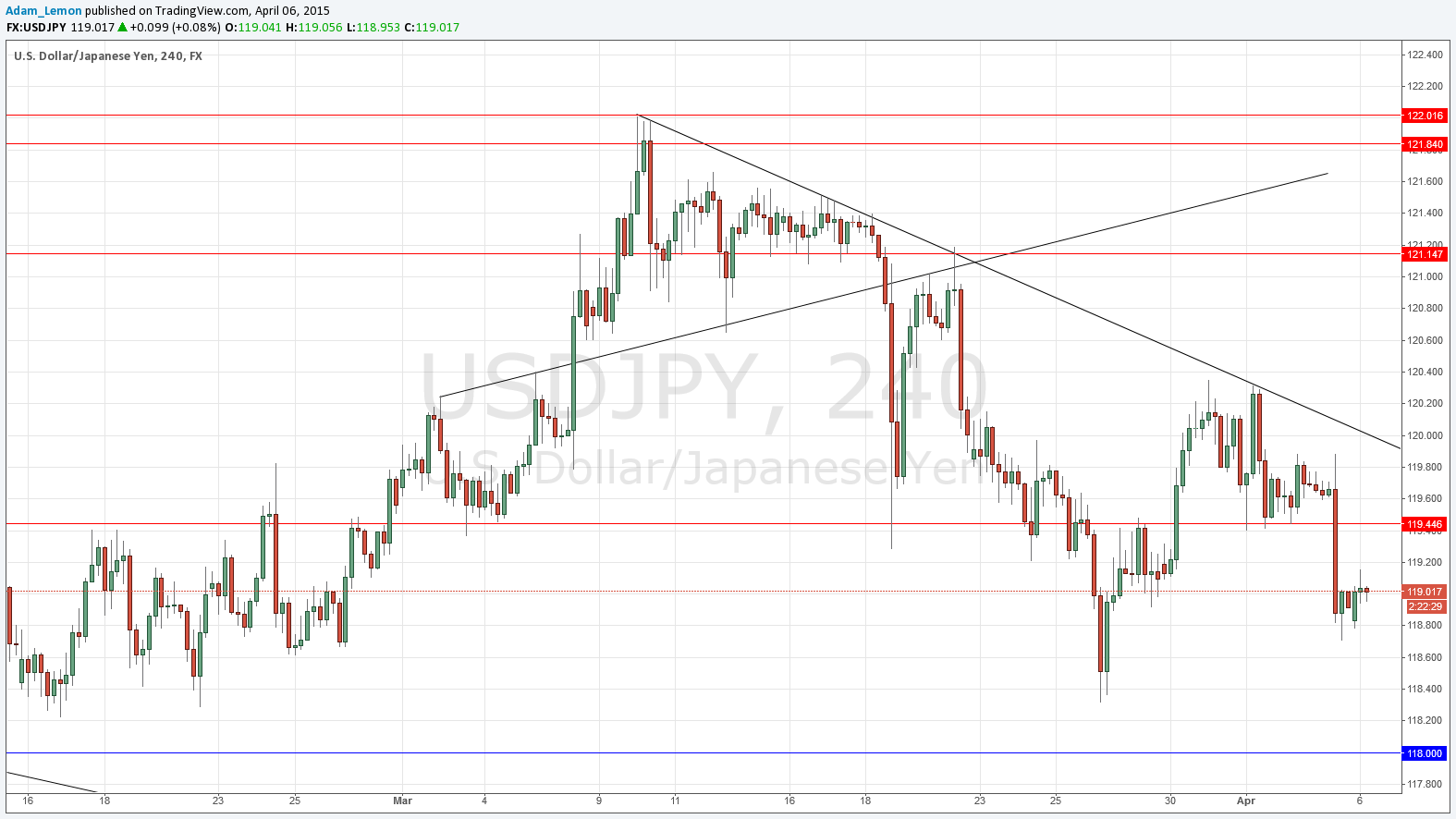

USD/JPY Analysis

Last Thursday I saw that the support at 119.50 was in danger of being broken and so it proved: this area is now likely to be resistant. The general direction of this pair has been bearish, and there is a very solid bearish trend line above that is now sitting just below the round and psychologically important 120.00 level. So, there is plenty of resistance above.

Below the current price, the area between 118.00 and 118.30 has continued to remain supportive and we might expect a bullish bounce there if we reach this area today.

Due to the U.K. and many other countries having a public holiday today, liquidity is likely to be low, although once New York opens it should pick up. No trades should be taken before the New York open.

There are no high-impact events scheduled today concerning the JPY, but there is regarding the USD. At 1:30pm London time, a member of the FOMC will be speaking at a minor conference, and any unscripted remarks could impact the USD.