USD/JPY Signal Update

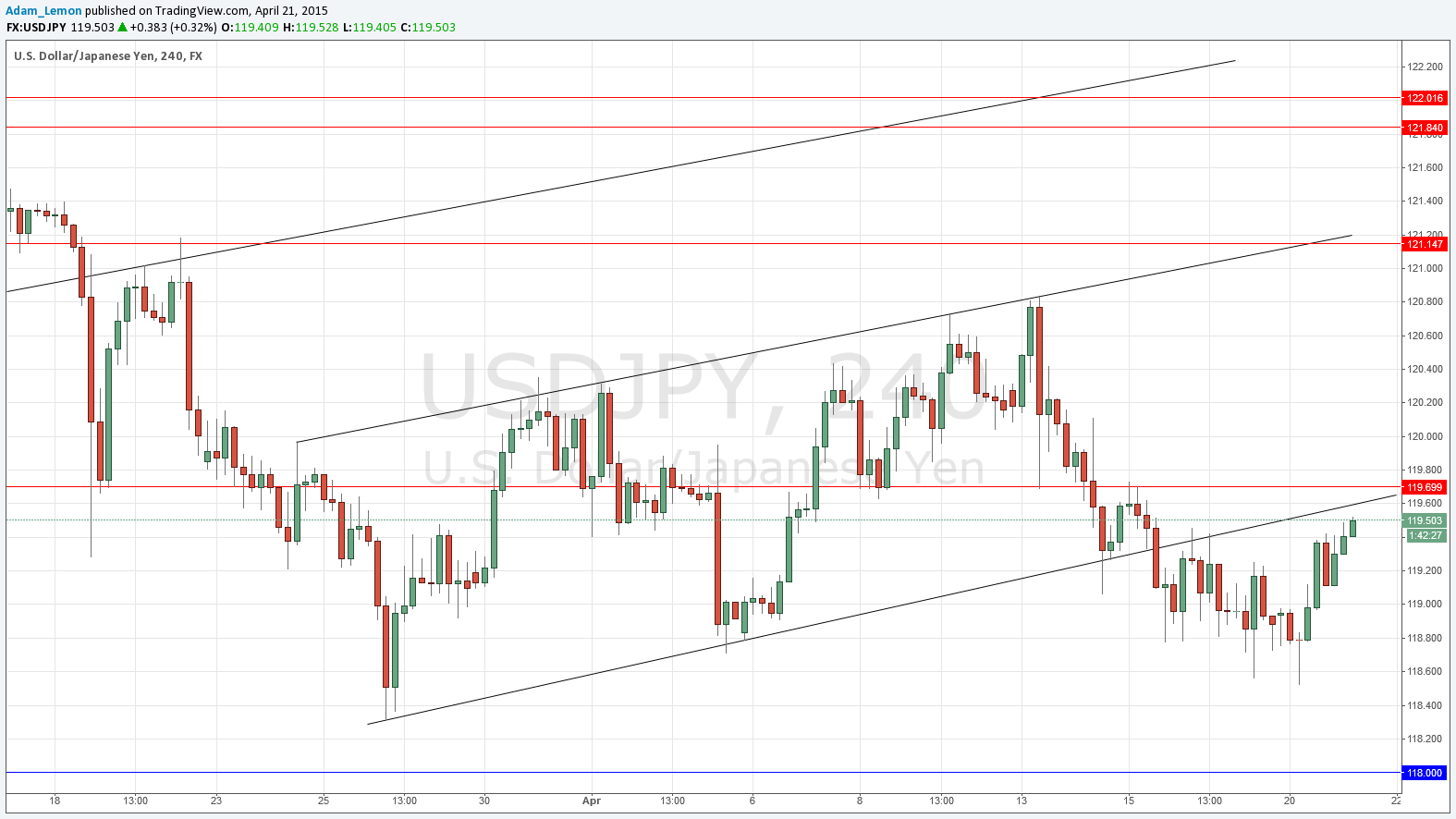

Yesterday’s signals were never triggered as the price did not reach 119.60 or 118.00.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next retest of the broken bullish trend line currently sitting at around 119.60, ideally with a simultaneous rejection of the horizontal resistance at 119.70.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run. Take further profit at 118.85.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 118.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 118.70.

USD/JPY Analysis

We have had a renewal of some USD strength which leads the price to approach what may be a key turning point, confluent with the broken bullish trend line at around 119.60 and a flipped resistant level at 119.70. A rejection of these levels could provide a solid basis for a short trade.

There are no high-impact events scheduled today concerning either the USD or the JPY.