Gold prices slipped for a third straight session on Tuesday as optimistic data on the U.S. economy dimmed the metal's appeal. Data released yesterday showed that Chicago Business Barometer increased to 46.3 from 45.8 and the Conference Board reported that its consumer confidence index climbed to 101.3 from 98.8 the prior month. The XAU/USD pair hit $1178.37 an ounce yesterday, the lowest since March 20, before bouncing back to the $1184.

Market players are understandably in a more cautious mode ahead of highly anticipated U.S. jobs data. Stronger economic data raise the possibility of an interest rate hike which supports demand for the greenback. Besides, developments in other parts of the globe appear to be giving investors another excuse to stick with the dollar. However, in the meantime, keep an eye on the major stock exchanges because weakness in these markets might give a temporary boost to gold.

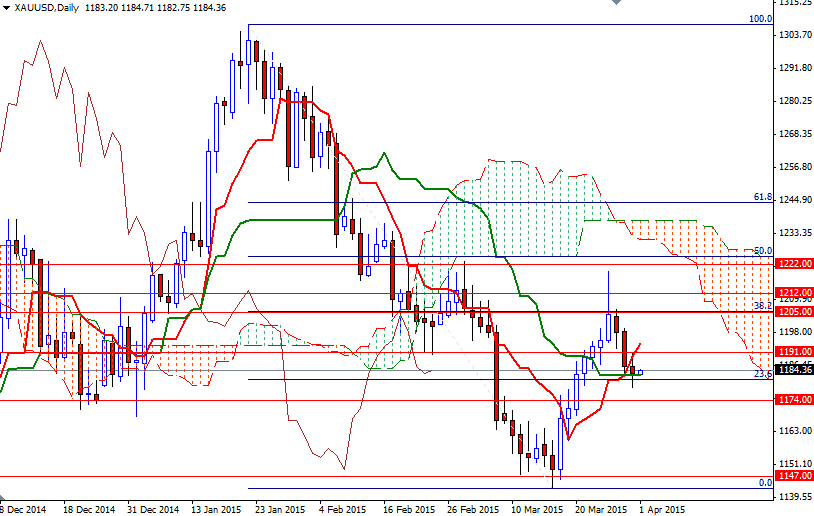

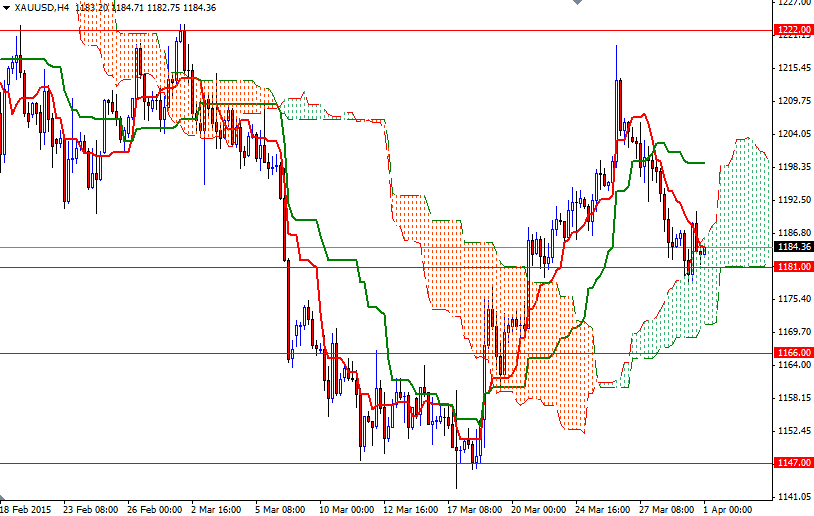

From a technical point of view, the XAU/USD pair currently sits on an important area. As you can see on the 4-hour chart, prices are inside the Ichimoku clouds and these clouds often act as strong support (or resistance depending on its location). There are also other supports such as the daily Kijun-sen (twenty six-day moving average, green line) and Fibonacci 23.6 in the same region. Intra-day supports are located at 1181 and 1174. That said, I think the bears have to drag prices below the cloud so that they can put more pressure on the market and test the 1166 level. If this support is broken, then 1155 and 1147 will probably be the next stops. On the other hand, if the market finds support as expected and breach the resistance at 1191, it is likely that XAU/USD will march towards the 1199/8 zone. Beyond that, the bears will be waiting at 1205.