Gold advanced for the first time in four days as the dollar weakened after a batch disappointing U.S. data fueled concerns about the strength of the economy. The ADP Research Institute said companies added 189K employees in March after a revised 214K gain in the prior month and data released by the Institute for Supply Management revealed that its manufacturing index declined to 51.5 from 52.9. The XAU/USD pair extended its gains and traded as high as $1208.44 an ounce after the market cleared the resistance at $1191.

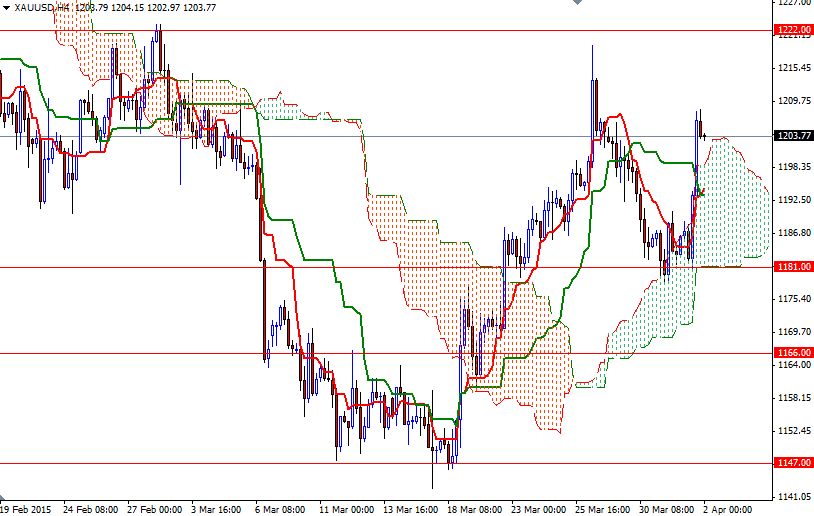

The employment sector data is closely watched by the U.S. central bank and could influence the timing of the first rate hike. However, as I repeat from time to time, the ADP's report is not a reliable indicator of the Labor Department's report on non-farm payrolls. After yesterday's gains the XAU/USD pair moved little during the Asian session. The pattern on the charts suggests that the pair will maintain its short term bullish bias as long as we continue to trade above the Ichimoku cloud on the 4-hour time frame.

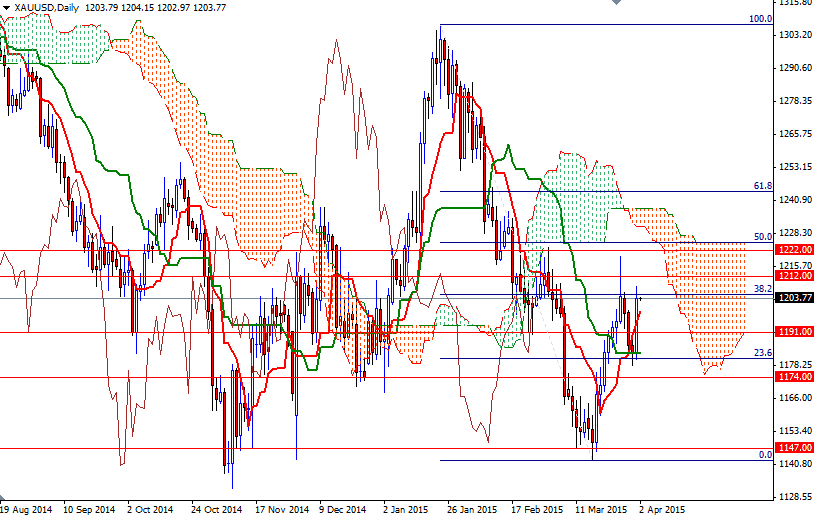

Speaking strictly based on the charts, support can be seen in the 1193.71 - 1191 area. If the bears increase the downward pressure and gold prices drop below 1191, we could see the pair testing the 1187/6 zone. The bottom of the Ichimoku cloud (4-hour chart) currently sits on the 1181 level, so a close back below this support would imply that the short-term technical outlook is shifting to the downside. If the bulls manage to defend their first camp around 1191, then they may find a new opportunity to test the next resistance at 1205/8. This will be the key level for the bulls to pass in order to challenge the bears at the 1214/2 battle field.