Gold declined for a third session in a row on Wednesday as the dollar gained some strength across the board after the minutes from the Federal Open Market Committee’s March 17-18 meeting suggested the U.S. central bank may not begin increasing interest rates by the middle of the year. "Several participants judged that the economic data and outlook were likely to warrant beginning normalization at the June meeting" according to records. The minutes also show that some officials thought "the normalization process could be initiated prior to seeing increases in core price inflation or wage inflation".

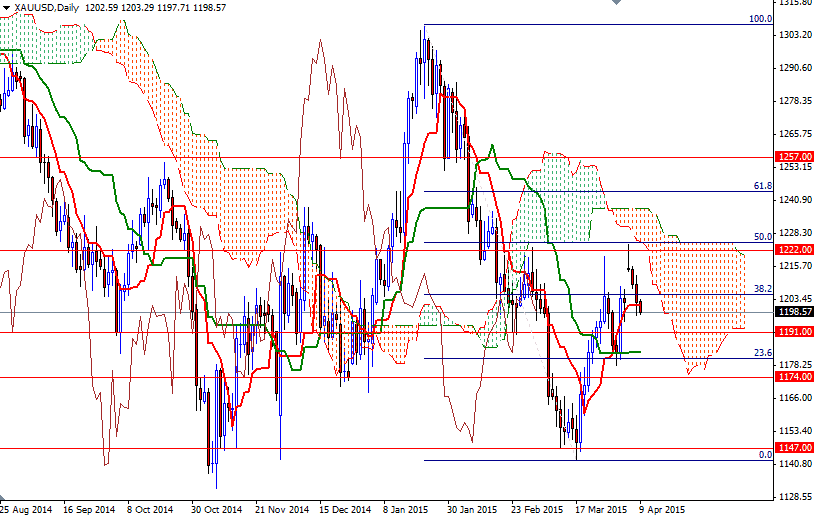

Recent data indicate that the U.S. economy cooled in the first quarter but it appears people are confident that growth will pick up in the second quarter. The precious metal is also being hurt by the idea that the dollar will continue to strengthen as other major economies are easing. Gold prices has fallen 2.08% since the market found resistance in the 1225/2 area (a former support/resistance and 50% retracement of the bearish run from 1307.47 to 1142.63).

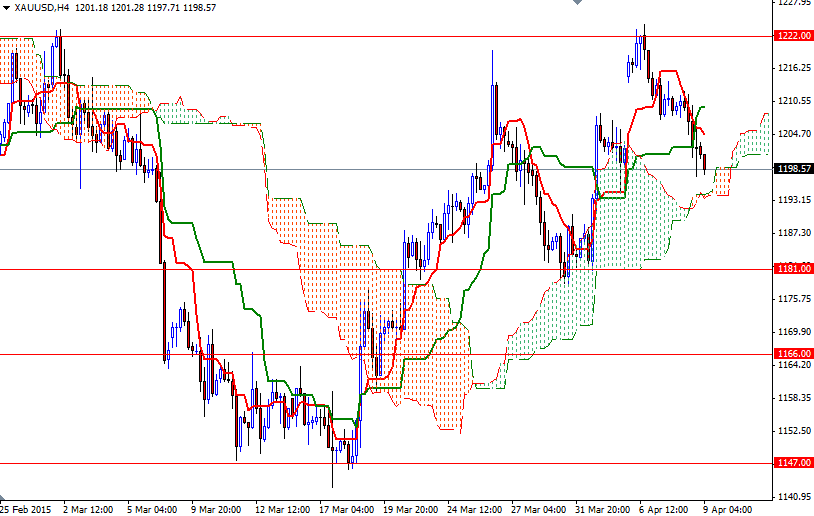

Speaking strictly based on the charts, gold prices will struggle to climb significantly higher over the medium term unless the market anchors somewhere above the daily Ichimoku cloud. Right now prices are between the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) on the daily chart and as you can see both lines are flat at the moment. From an intra-day perspective, I think the key levels to watch will be 1193/91 and 1210/08. If prices successfully break below the support at 1191, it is likely that the market will be testing the 1183/81 area afterwards. However, if the Ichimoku cloud on the 4-hour chart holds the market and prices start to rise, the XAU/USD pair may revisit 1204 and 1210/08.