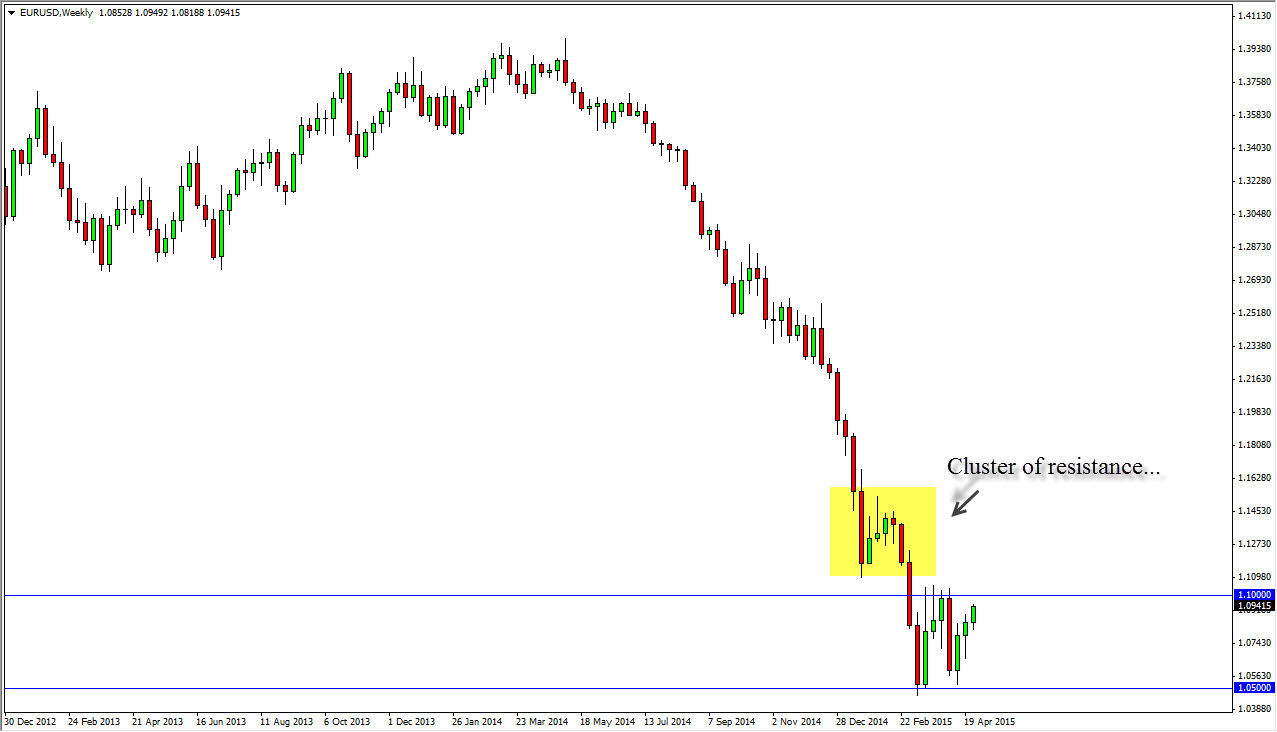

The EUR/USD pair has spent the last couple of weeks grinding its way higher. However, I still see this market as being consolidative, as the market has bounced around between the 1.05 and the 1.10 levels. Even if we break above the 1.10 level, I am a bit concerned about going long until we clear the 1.15 handle as there is a cluster that should cause quite a bit of noise.

It would not surprise me at all to see this pair go above the 1.10 level, but I think ultimately it will end up being a selling opportunity. As I write this, and we are closing out the month of April, it appears that the Euro is getting a little bit of a lifeline. However, when you look at the weekly chart you can see that we are far from reversing the trend. Unfortunately, far too many traders will look at the last couple of hundred pips and have visions of glory buying the Euro.

It’s probably only a matter time before the sellers get involved, simply because there’s far too much that could possibly move the Euro, most of it being negative. Let us not forget that there is still a lot of drama involving the Greeks, and nobody really seems to know where most of the debts are. Worse yet, it seems that the Europeans are willing to do just about anything to placate the Greeks when push comes to shove, and that means that there will be loose monetary policy for the foreseeable future, and this can erode faith in the ECB itself. I think the European Central Bank will continue to try to drive down the value of the Euro, simply because it makes those debts less burdensome. Because of this, I still believe that this pair will go down to the parity level, although I would be surprised to see it happen during the month of May. I believe we will continue to bang around in the same general vicinity. Shorter-term trades will probably be the appropriate way to play this pair.