AUD/USD Signal Update

Last Wednesday’s signals expired without being triggered.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

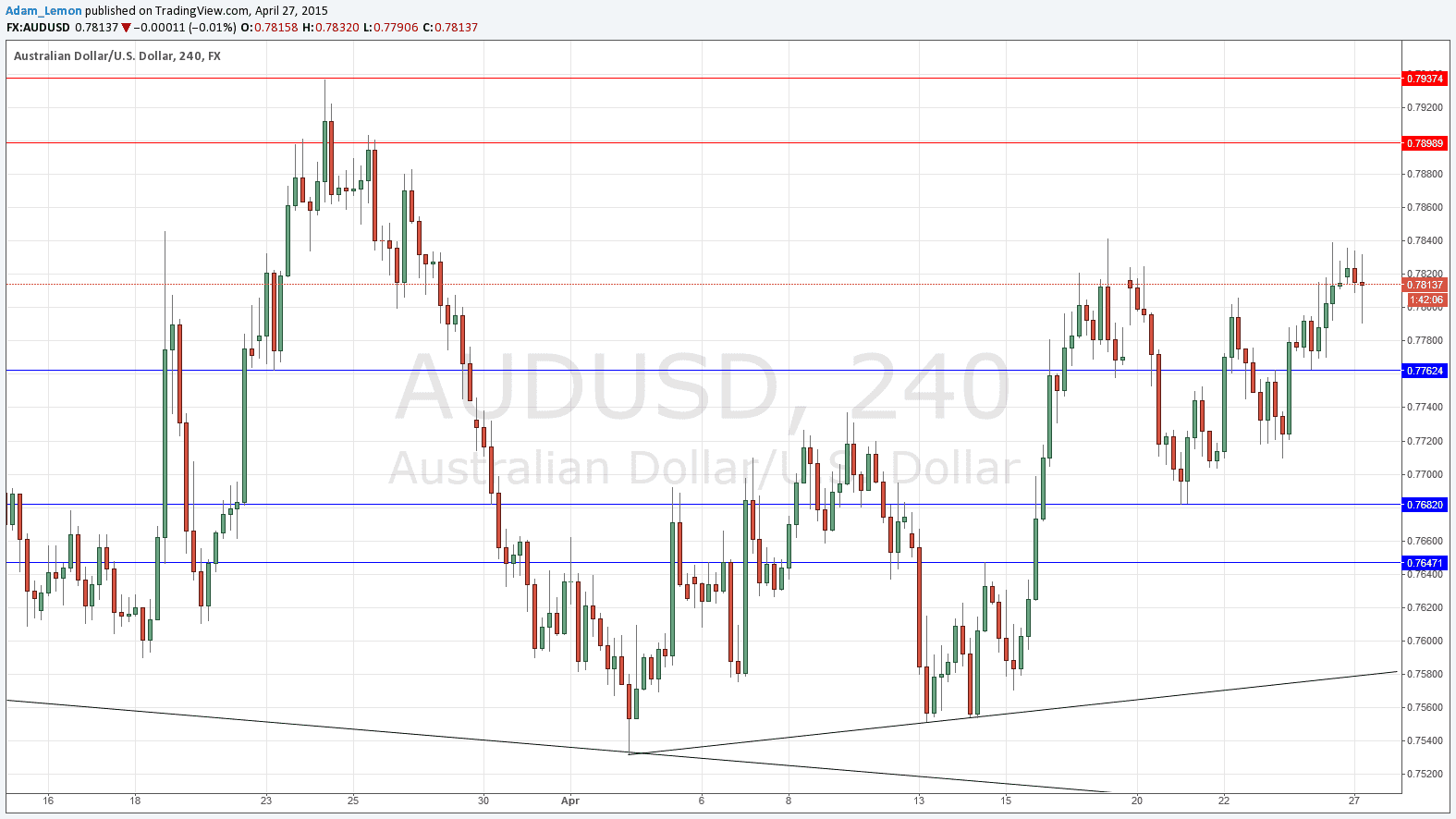

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the next touch of 0.7762.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following some bullish price action on the H1 time frame immediately upon the next touch of 0.7682.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following some bearish price action on the H1 time frame immediately upon the next test of 0.7900.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

In my previous forecast last Wednesday I wrote that we might well see further consolidation and that is pretty much what happened in the second half of the previous week. However this pair is looking more bullish now as the power seems to lie with the buyers and it ended the week close to the top of its range. They key thing to watch now will be whether 0.7762 holds as support. The moment of truth will probably arrive with the FOMC announcement on Wednesday.

My colleague Christopher Lewis is less bullish than me, expecting that 0.7850 will hold as resistance during the near term.

There are no more high-impact events scheduled today concerning the USD. Regarding the AUD, the Governor of the RBA will be speaking at 11:40pm London time.