AUD/USD Signal Update

Last Monday’s signals were not triggered as there was no bullish reversal at 0.7662.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the next test of the channel’s lower bullish trend line currently sitting at around 0.7515.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following some bearish price action on the H1 time frame immediately upon the next test of 0.7662.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

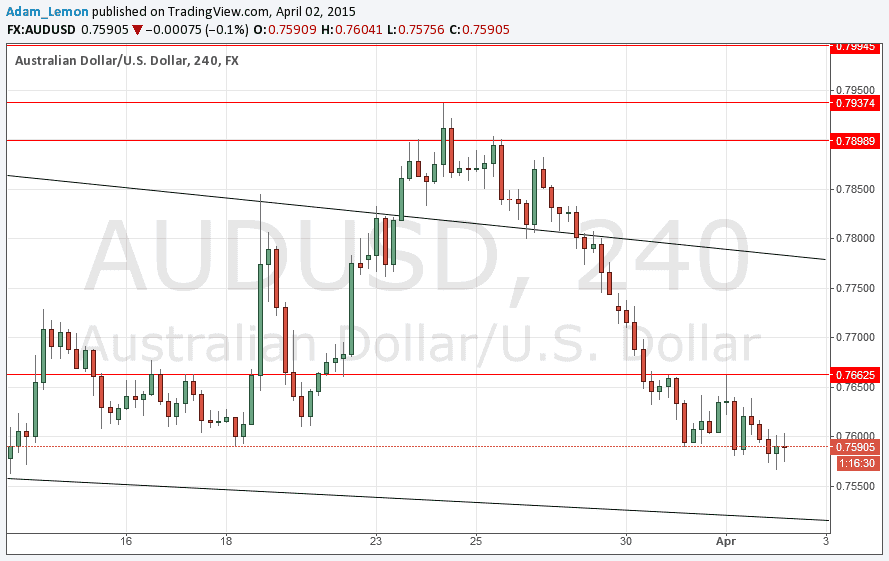

This has been the most bearish of all the USD pairs, falling steadily all week. It is also within a medium-term bearish channel.

However the price is now approaching the psychologically significant level of 0.7500 and this is now quite confluent with the channel’s lower trend line. A long here would have to be taken conservatively as it might be hard to hold such a trade over the pre-NFP volatility tomorrow.

There is flipped resistance at 0.7662 which looks like a good area at which to seek a short after any bullish pull back.

There are no high-impact events scheduled today concerning the AUD, but there is regarding the USD. At 1:30pm London time, there will be releases of Trade Balance and Unemployment Claims data.