USD/JPY Signal Update

Yesterday’s signal expired without being triggered as the price never reached 118.93.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

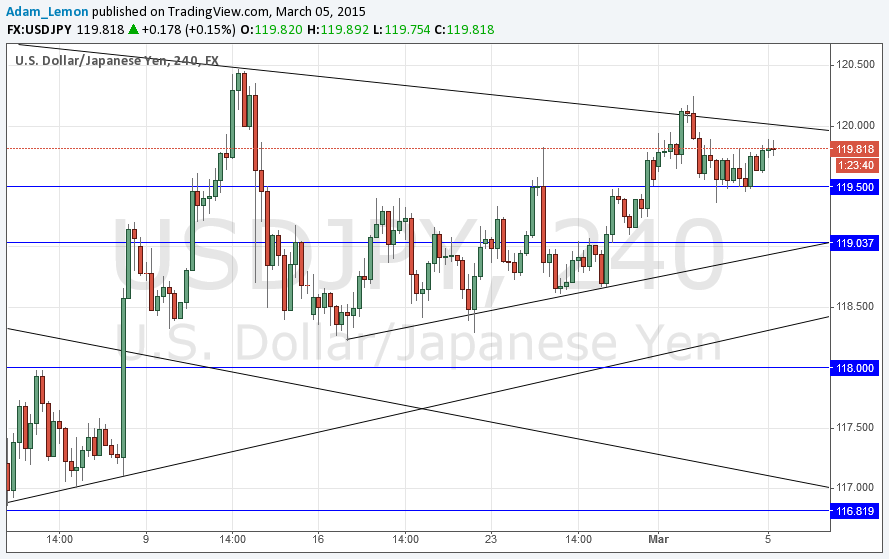

Go long following some bullish price action on the H1 time frame immediately upon the first test of the inner bullish trend line currently sitting at around 118.97.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair was again quiet yesterday for another consecutive day.

The price is being squeezed as we print higher and higher supports, but fail to break up past the bearish trend line at 120.00. Due to the increasing support below, I cannot look to go short at the bearish trend line as I doubt it would produce much movement.

It is likely that the market is waiting for the NFP data tomorrow before this pair will break one way or the other. Nevertheless, due to the strong USD trend, there should be some edge in being positioned long as a strong NFP number could be expected to produce a breakout above 120.00. This could be possible to do with confidence at 119.00 and perhaps much later during the Tokyo session at the new local support of 119.50 also.

There are no high-impact events scheduled for the JPY today. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.