USD/JPY Signal Update

Yesterday’s signals were invalidated as although the price did reach and bounce bullishly off the trend line at 119.30, unfortunately there was no clear price action on the hourly chart to enter long.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.03.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next test of the bearish trend line currently sitting at around 120.85.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

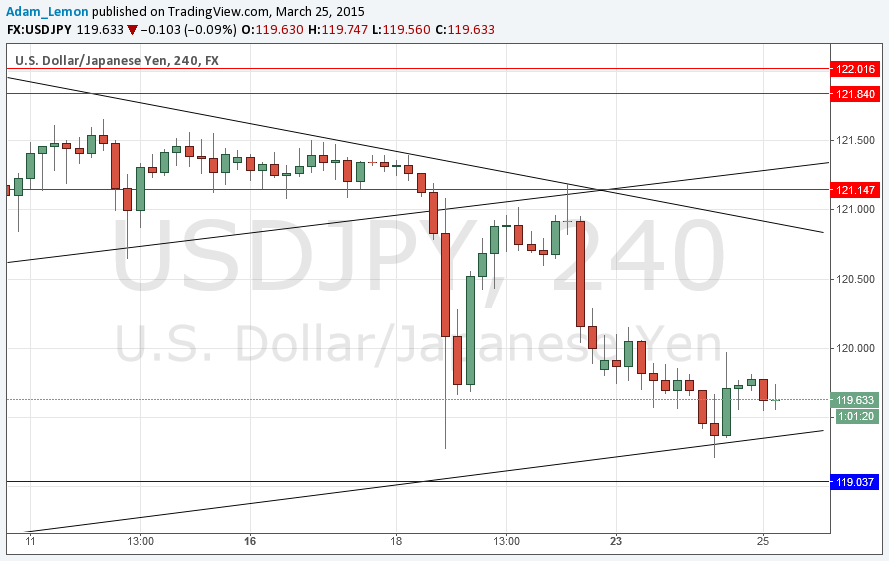

I forecast yesterday that the trend line at around 119.30 was the most likely level at which we would find good support and that was how it went when the price reversed off it during the New York session.

The price action yesterday invalidated two well-established supportive trend lines so the technical picture is clearer now.

We have not bounced very far up off the trend line so I would not use it again today as support, but instead look to the 119.03 level.

Above there is a new bearish trend line that has had at least 2 tests, plus a flipped level at 121.14, both of which are fairly confluent with a round number at 121.00. The entire area should be nicely resistant if the price returns there in the near future.

There are no high-impact events scheduled today concerning the JPY. Regarding the USD, at 12:30pm London time here will be a release of U.S. Core Durable Goods Orders data.