USD/JPY Signal Update

Last Thursday’s signals were not triggered as although the price did reach 120.66, there was no bearish price action before the level was decisively broken.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

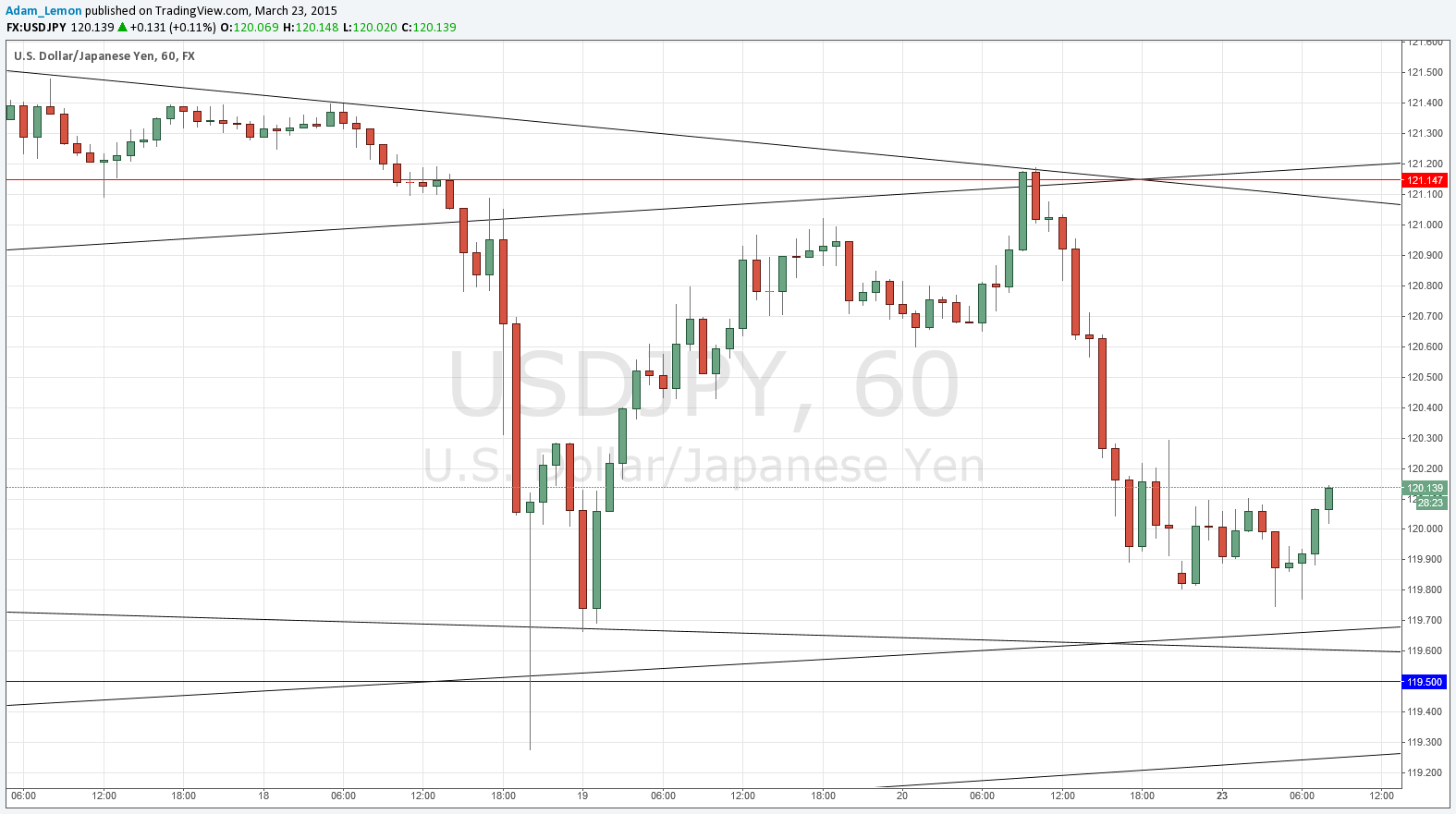

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 119.50.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of the bearish trend line currently sitting at around 121.00.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair has settled down quite a lot and now the technical picture looks quite nice and predictable. Below us there is a confluence of two trend lines plus a horizontal support level and round number at around 119.50. This area is likely to continue to provide support despite the shine coming off the USD lately.

Above us there is a new bearish trend line that has already had two touches fairly confluent with a flipped support to resistance level at 121.14. There is also another, older trend line there, plus the whole number of 121.00. This area is likely to provide resistance.

This leaves quite a lot of room in between for the price to swing around.

My colleague Christopher Lewis remains long-term bullish. I agree but think there can be good shorting opportunities in the meantime, as this pair seems to be in no hurry to go up, and the Bank of Japan is not keen to see it any higher right now either.

There are no high-impact events scheduled today concerning either the JPY or the USD.