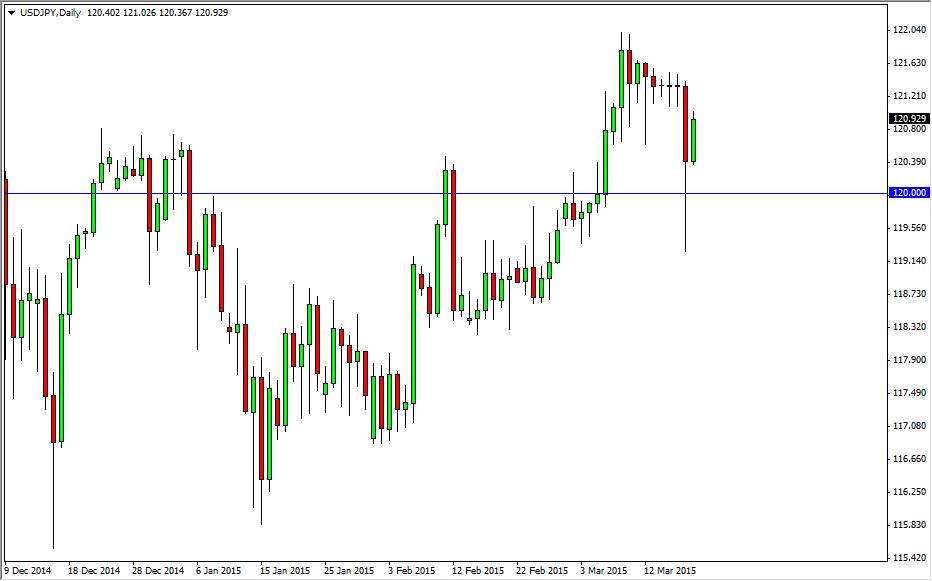

The USD/JPY pair broke higher during the course of the session on Thursday, essentially wiping out most of the losses from Wednesday. We now have shown the 120 level to offer support, so it makes sense that the market should continue to go higher. I recognize that the 122 level has been resistive, but I believe that the market is eventually going to break out above that level. I believe once that happens, we should then head to the 125 handle given enough time. I also think that pullbacks on short-term charts will continue to offer buying opportunities, as the market is most decidedly bullish.

Ultimately, I think that this is more or less going to turn into a “buy-and-hold” type of market, as the US dollar continues to strengthen overall. In fact, I have no interest in selling the US dollar overall, so I believe that the situation in this market simply warrants patience, and perseverance overall. In fact, I believe that short-term pullbacks will continue to offer buying opportunities in general.

Bond yields

Bond yields in the United States are still stronger than Japan, and that’s going to be the case going into the future as well. With that, this market should continue to grind much higher, as the 10 year yields continue to spread between the two. That being the case, I think that there is a bit of a floor in this market, somewhere near the 118 level. I think that the Bank of Japan will continue to work against the value of the yen on top of everything else, so this creates a bit of a perfect storm going forward in my opinion.

Once we break above the 125 level though, I believe this becomes a long-term career building type of market. I think that the buyers will continue to step in every time it falls, just like we saw before the financial crisis.