USD/CAD Signal Update

Last Wednesday’s signals were not triggered as the price cut right through 1.2733 and 1.2625 following the FOMC announcement before rebounding.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm New York time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next test of 1.2500.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next test of 1.2739.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

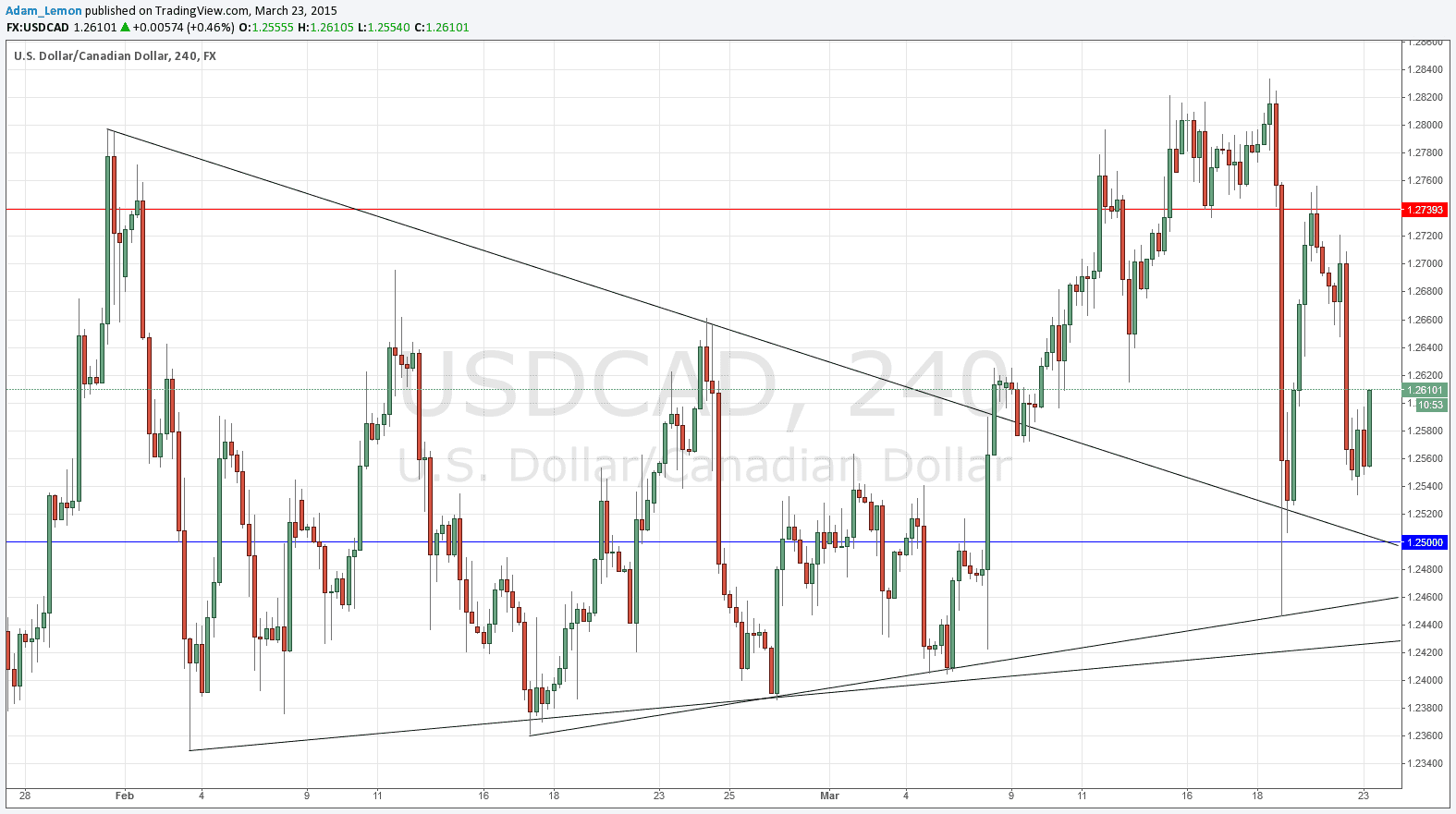

USD/CAD Analysis

This pair enjoyed a very sharp fall which was then followed by decreasing but still quite sharp swings. The initial sharp fall took the price back right into its old consolidating triangle as shown in the chart below. Both of the triangle’s old trend lines have been shown to be supportive, acting as a reversal to this initial fall. There is a confluence of support below plus a psychological level at 1.2500 and it will probably be hard for the price to break below this area, at least for a while.

Above it is hard to see a really clear level that is going to act as resistance before 1.2740 which has recently been pivotal as both support and resistance. Note its confluence with another psychological level: 1.2750.

There are no high-impact events scheduled today concerning either the CAD or the USD.