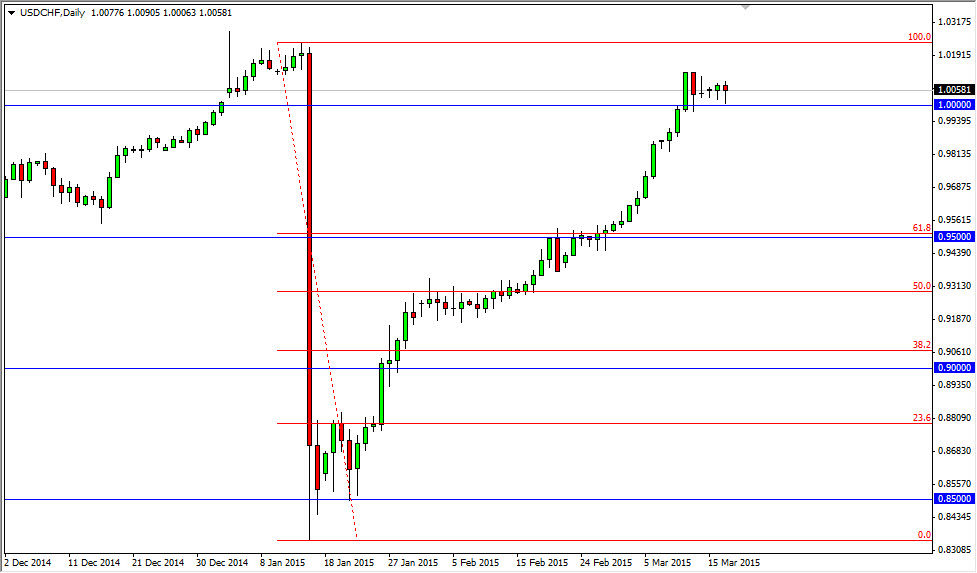

The USD/CHF pair broke down during the course of the session on Tuesday, testing the parity level yet again. By doing so, the market found plenty of support and therefore formed a nice-looking hammer. That being the case, the market looks as if it should continue to go higher, and as a result the market should test the recent high that we had seen in this market. That sends this market looking for the 1.02 level, and if we can get above there we feel that the market should continue to go much higher. After all, the US dollar was punished disproportionally as the EUR/CHF pair meltdown a couple of months ago.

Even if we broke down below parity, there is a massive amount of support down at the 0.95 level, and I believe that now that we have extended this move so high, it’s almost impossible to imagine that we are going to turn back around and do a complete round-trip yet again. With we get above the 1.02 level, I recognize that there is a target at the 1.05 level, and the 1.08 level.

Buying dips

I continue to buy dips in this pair, and quite frankly look at it as value in the US dollar. The US dollar of course is the favored currency around the world, and the Swiss have the misfortune of having Europe as its greatest trading partner. In fact, the Swiss send 85% of their exports into the European Union, so that will continue to work against the Swiss economy anyway. We believe that the market is a bit overbought at this point though, because of the last couple of weeks, but a simple grind sideways could be exactly what’s needed to build up enough momentum to break out to the upside and completely eliminate that massive red candle that started the meltdown. Above there, we should start to see more normal action in this pair, as we continue to enter a long-term uptrend.