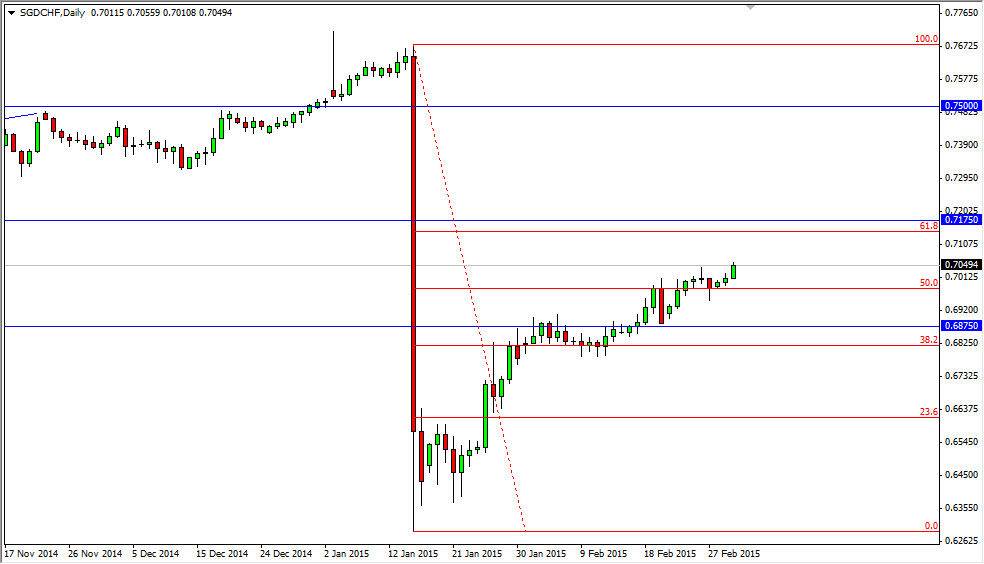

The SGD/CHF pair broke higher during the course of the session on Tuesday, as we cleared the most recent high, as a result it now looks as if we are ready to continue grinding away to the 61.8% Fibonacci retracement level. With that, I believe that this market will continue to grind higher, but not necessarily shoot straight up. With that, I believe that this is a buying opportunity that is going to take a bit of patience, but should continue to climb. The 0.7150 level above will be resistance, so I think that the market will probably struggle to break out above there.

I believe that pullbacks continue to be supported, especially down near the 0.69 handle. Ultimately, I believe that the market will pull back from time to time, but ultimately should continue to grind its way much higher. Pay attention to the USD/CHF pair, as the two pairs tend to follow each other, and I believe that one of the best ways to think about the Singapore dollar is that it is essentially the Asian version of the US dollar.

Steady as she goes

I believe that this market will continue to grind higher but it won’t necessarily be exciting. That’s okay though, because that’s not what you’re going to want in this type of market. Quite frankly, this is going to be a slow move but should be steady as the Singapore dollar itself tends to trade that way. On top of that, this pair represents money running from Europe to Asia. After all, the Swiss economy is highly leveraged to the European economy, as Switzerland sends 85% of its exports into the European Union. On the other hand, Singapore has very little exposure to both Europe and Switzerland, meaning that this is a bit of a safe haven in this particular circumstance.

We can break above the 0.7150 level, I think that we go to the 0.73 level next, followed by the 0.75 handle. As far selling is concerned, I have no interest in doing so until we get down below the 0.68 level.