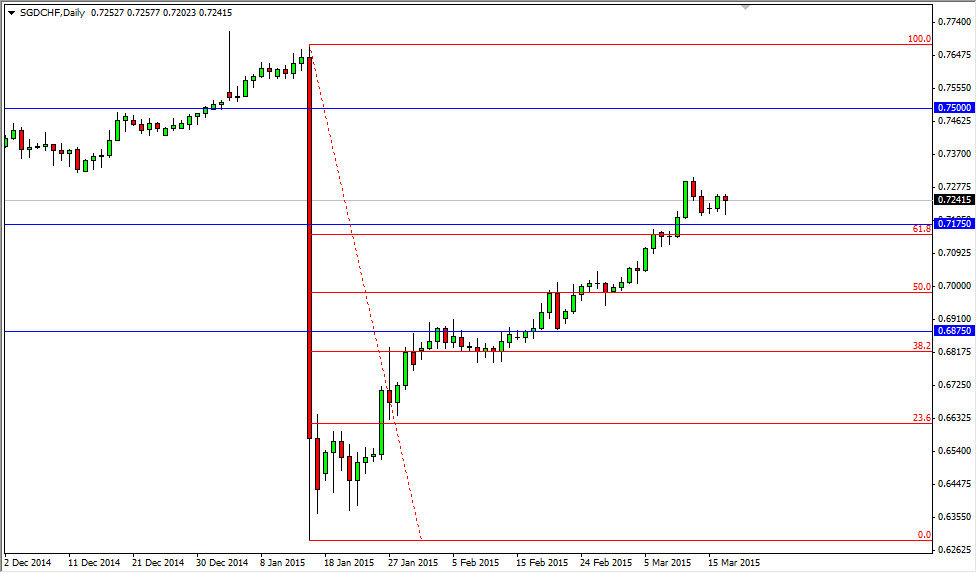

The SGD/CHF pair fell during the course of the session on Tuesday, but found enough support just above the 0.7175 level to turn things back around and form a nice-looking hammer. This hammer is sitting just above the 61.8% Fibonacci retracement level from the massive meltdown that we had seen in this pair due to the Swiss National Bank and its removal of the currency peg and the EUR/CHF pair. Ultimately, this market looks like it has broken above all of the major messages of resistance, and now is free to wipeout the massive meltdown candle that we had seen form. This is the way that the Swiss franc is trading against most currencies, with perhaps the exception of the Euro itself. With that, I believe that the Swiss franc is about to lose significant value against many of the peripheral currencies around the world.

Buying dips

I continue to buy dips in this pair, and I believe that ultimately the Singapore dollar will continue to appreciate in value against the Swiss franc. The roundabout way, you can think of the Singapore dollar as the Swiss franc of Asia, as it is a safety currency. However, you also have to keep in mind that the Swiss have the misfortune of dealing with the European Union as biggest customers, which of course is going to be pretty difficult for the Swiss economy. On the other hand, Singapore is a financially stable region which of course doesn’t have to deal with Europe directly.

Even if we break down below the 0.7175 level, I believe that it’s only a matter time before we find support somewhere near the 0.70 level. Ultimately, this market should continue to go higher over the longer term and therefore I think that you can only sell the Swiss franc going forward, and as a result I remain very positive of this market. I have no interest whatsoever in buying the Swiss franc at this point, as I see plenty of similar setups in the Swiss franc against all kinds of currencies.