Gold prices dropped another $5.11 an ounce to $1161.48 yesterday, extending losses for a seventh straight session, as investors continued to price in expectations of a Fed rate hike as early as June. The XAU/USD pair traded as low as $1155 before climbing back above the $1162 level. It seems that reviving physical demand in Asia and a sharp pullback in equity markets lend some support to gold but these factors produced a small bounce as far.

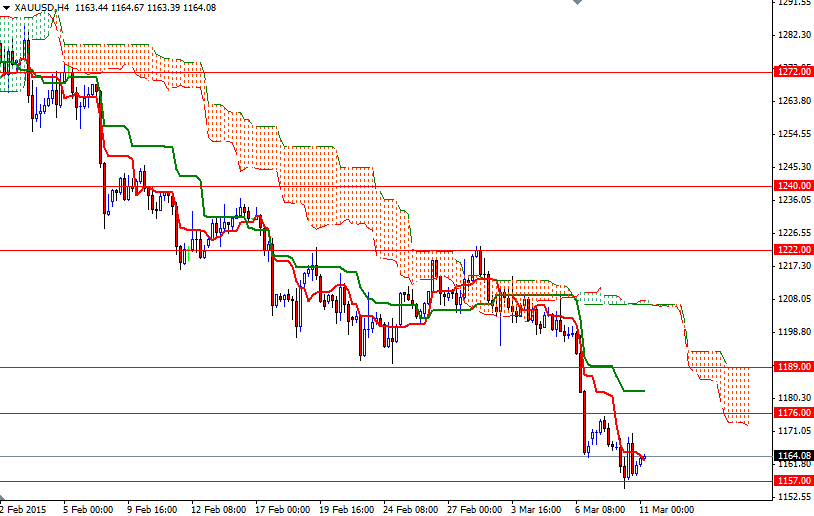

Although, a significant correction in stocks could cause market players to flee from equities and prompt funds to get back into gold, rallies could be capped by strength in the dollar. The market has traveled quite a distance since the outlook on the 4-hour chart became extremely negative. But of course, that doesn't change the fact that the path of least resistance for gold still appears lower and betting against the trend is a good way to lose money.

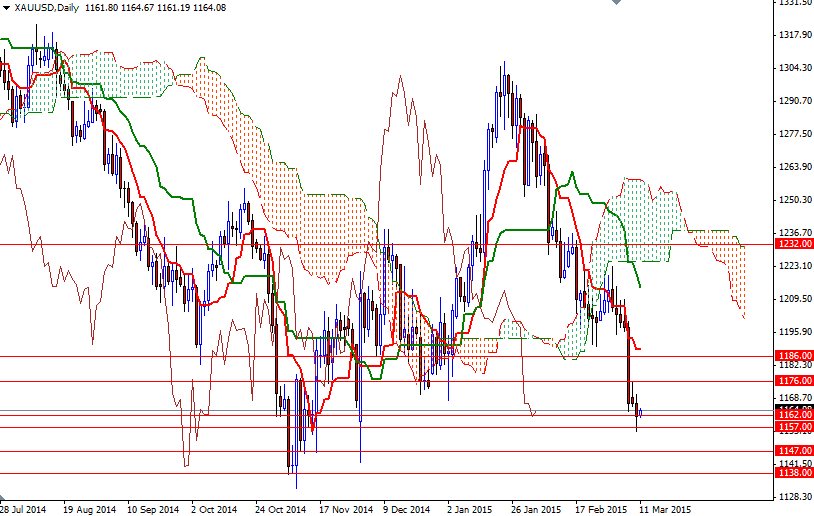

On the upside, the key levels to watch are 1176 and 1189. Until we anchor somewhere above the Ichimoku clouds on the daily chart, there will not be any real technical reason to buy gold. However, closing above this resistance could signal a run up to 1200 or 1210. If the market resumes its bearish sentiment and prices break below yesterday's low, the XAU/USD pair will probably deepen its losses and test the support at 1147. The bears will have to capture this camp if they intend to make an assault on the 1138 level.