Gold prices settled lower on Tuesday but remained within the range of the previous 4 trading sessions. Not surprisingly, markets are in a cautious mode ahead of the Federal Reserve’s two-day policy meeting which begins today. Since the minutes of the latest meeting had showed that the Federal Reserve is much closer to begin normalizing policy, the outcome of this meeting will be critical. The possibility of higher interest rates this year also pressured equities but the recent declines failed to offset pressure on gold from the rising dollar.

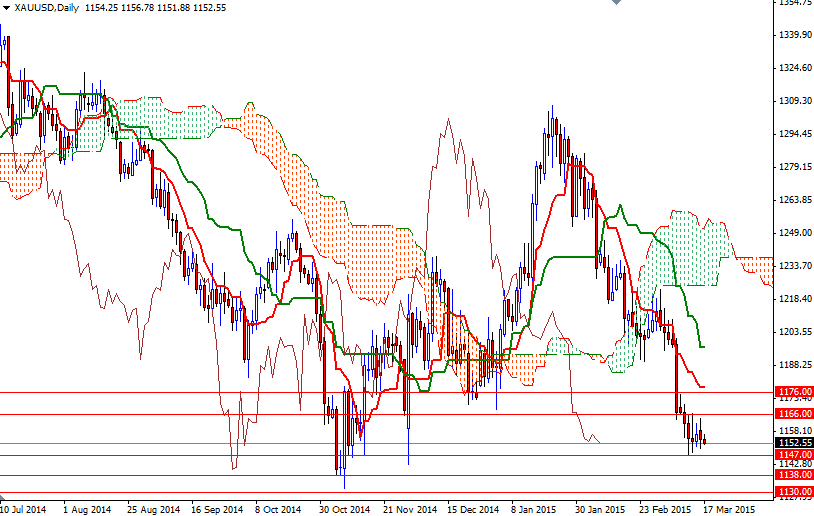

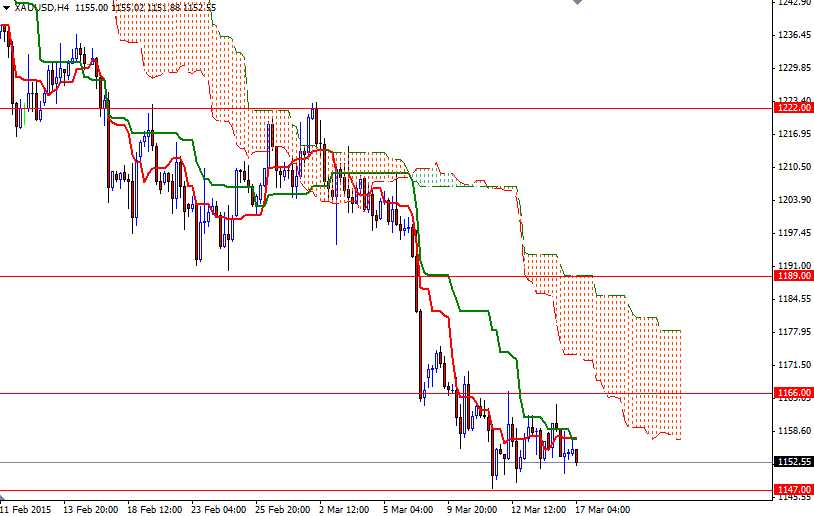

I think the XAU/USD pair will have a hard time gaining traction in either direction at this point. We have been locked in a tight trading range of $1147 to $1166 so short term traders should pay attention to these 2 support-resistance levels. Although some may find it boring, sooner or later we will reach a point where it will simply have to break one way or the other.

If the bulls take the reins and push prices beyond 1166, they may have a chance to revisit the resistance at 1176. A daily close behind this level would indicate that the market is aiming for 1189. However, keep in mind that the odds favor further downside as long as the market remains below the Ichimoku clouds on both the weekly and daily charts. In other words, gold prices may struggle to climb significantly higher over the medium term unless this gloomy technical picture changes. If we drop below 1147, the market will probably head towards the 1138 level. I believe the 1130 level is a strategic point for the bears to conquer in order to start a journey to the 1092/85 area.