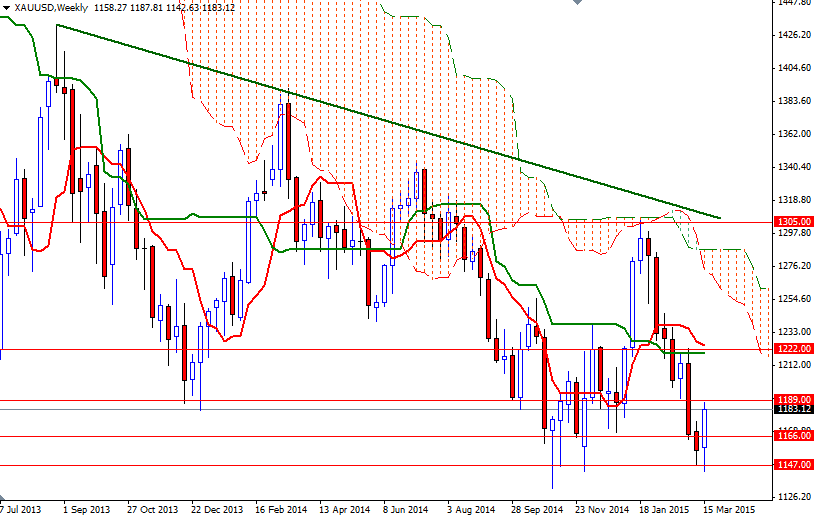

Gold rose for a third straight session on Friday as weakness in the dollar bolstered demand for the precious metal. Gold prices which slumped to a three-month low of $1142.63 earlier in the week got a boost from the Fed's announcement and ended the week up nearly 2.2%. Speaking after the central bank scrapped its pledge to be "patient" on rates, Federal Reserve Chair Janet Yellen suggested the Fed could wait beyond June to begin the normalization process. She also signaled that their retreat won't be a steady, uniform process and the pace of rate hikes is likely to be slower than in the past.

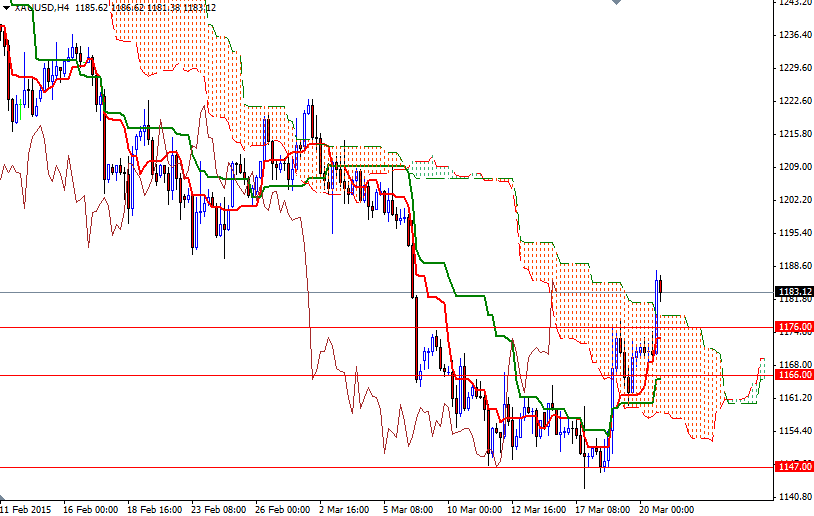

A delay in pushing borrowing costs would be seen as positive for gold (in the short term) but, whether it's June or September, the Fed will eventually end its zero rate policy. I think the bulls will be taking advantage of this situation and try to push prices higher before heading towards the 1092/66 area. The XAU/USD pair ended the week above the Ichimoku cloud on the 4-hour time frame plus we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross on the same chart.

If the support in the 1166/0 area holds, I think the bulls might have another chance to tackle the 1192/89 resistance level. Beyond that, 1204/0 will be the key level for the bulls to pass in order to start a journey towards 1225/2. However, if the XAU/USD pair encounters heavy resistance and starts to fall, we could possibly see the market testing the 1166 and 1160 levels. A break below this level could send prices back to 1147 area that has been supportive lately.