Gold prices ended Thursday's session nearly unchanged after a volatile day that saw prices swing between gains and losses as the bulls and bears struggle for near-term control. Although the strong bearishness continued, the market found some support around the $1147 area after disappointing U.S. retail sales figures tempered the outlook for a June interest rate hike by the Federal Reserve. The Commerce Department reported that retail sales dropped 0.6% in February, marking the third straight fall. On the other hand, separate data from the labor Department showed jobless claims declined 36K to 289K, indicating that the labor market remains on the right track.

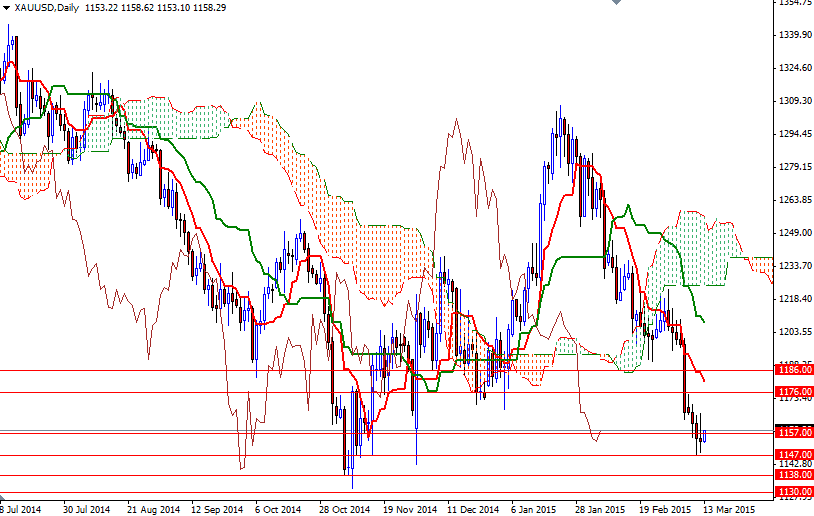

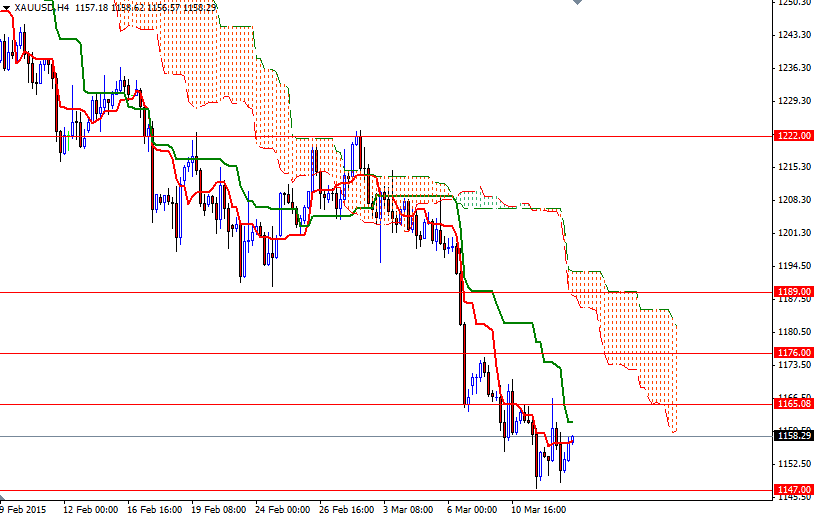

Speaking strictly based on the carts, the XAU/USD pair overall looks strongly bearish. Prices continue to feel pressure from the Ichimoku clouds on the weekly, daily and 4-hour charts. Plus, as you can see, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. However, the area between the 1147 and 1138 levels has been supportive in the past so it would not be surprising to see to some consolidation if it remains intact.

With that in mind, I will be keeping an eye on the 1147 level. If the market makes some kind of temporary bottom here, we could see a push up towards the 1176 - 1189 region where the Ichimoku clouds reside on the 4-hour chart. But of course, in order to gain enough traction, the bulls will have to push prices above the 1165 resistance level first. Falling through the 1147 level would suggest that the bears are getting ready to challenge the support at 1138. Closing below 1138 would make me think that the 1130 level will be the next stop.