Gold prices ended Wednesday's session down 0.58% as a robust dollar and technical selling pressure continued to weigh on the market. The XAU/USD pair slumped to $1147.44, the lowest since December 1, after prices failed to hold above the 1157 support level. The possibility of the Federal Reserve raising rates sooner rather than later has been this market’s bearish activity but I think lackluster physical demand from Asia is another factor working against the precious metal.

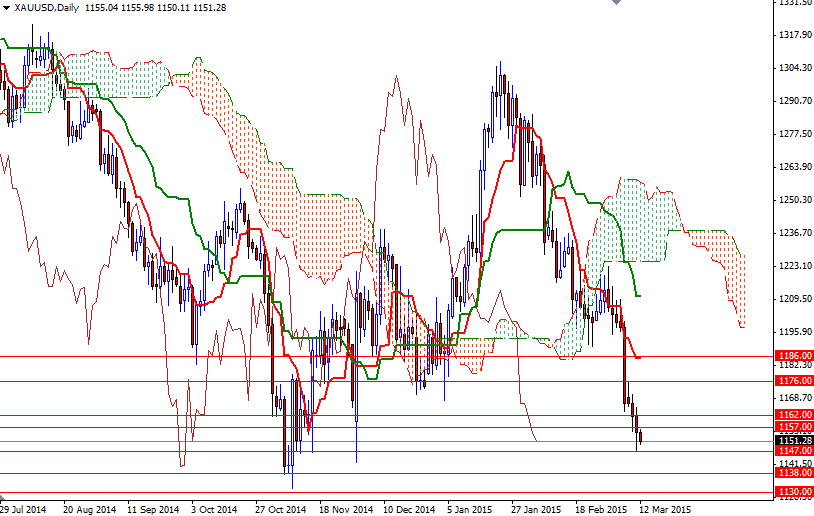

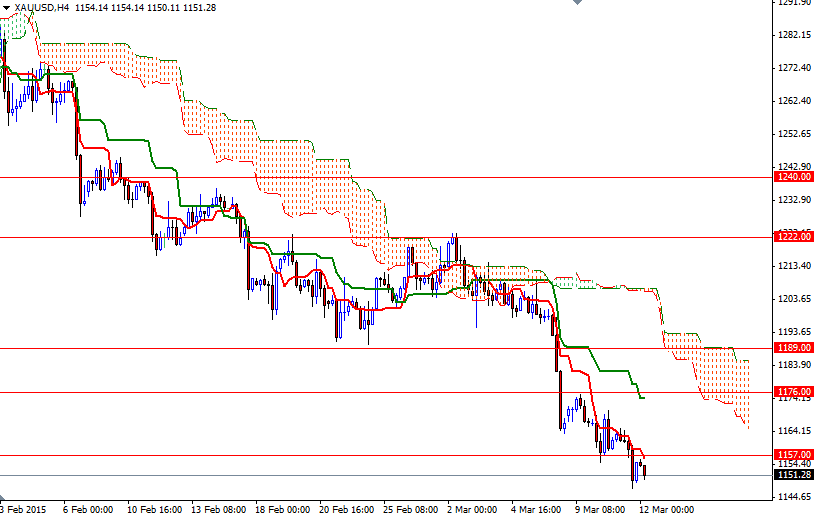

Technically speaking, the weekly, daily and 4-hour charts remain bearish while the pair is trading below the Ichimoku cloud. We also have bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on both the daily and 4-hour time frames. In other words, further downside risk is still valid and the 1138/0 zone looks like the next port of call.

I think that support will play an important role going forward because a successful break below 1130 may trigger a fresh sell-off that can drag gold prices towards the 1092 level. To the upside, initial resistance is at 1157. Beyond that, resistance can be found at 1162/5.08 and 1176. The first important hurdle gold needs to jump is located at the 1186 level. Today sees the release of U.S. retail sales data which will be closely watched ahead of next week's FOMC meeting.