GBP/USD Signals Update

Yesterday’s signals were not triggered as although the price did reach 1.4775 during yesterday’s London session, it formed a doji candle that was not a bullish indication.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today.

Long Trade 1

Long entry if at 9am London time the hourly candle closes in the top quarter of its range and above 1.4850. Entry should be set for 1 pip above the high and trigger within an hour.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

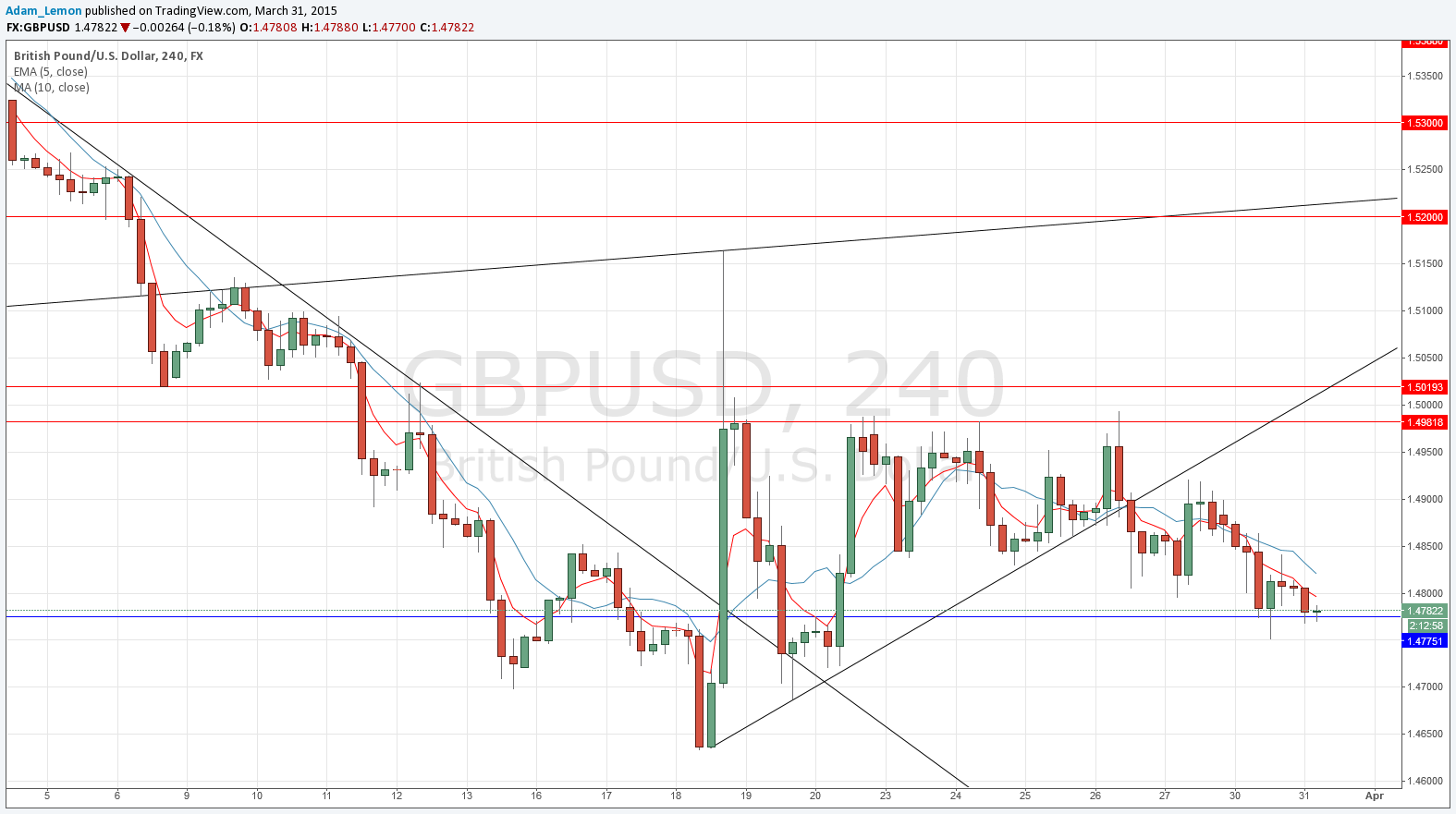

Short entry following a bearish price action reversal on the H1 time frame immediately upon the first entry into the resistance zone shown on the chart below currently between 1.4981 and 1.5019.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

Yesterday was a relatively quiet, but clearly bearish day. However the support I identified at 1.4775 has been persistent and has not broken down yet. It is likely to be pivotal early in today’s London session. A strong rise up off it before the news will be indicative of a bullish day; a fast breakdown, a bearish day. Of course there are high-impact news events due after that time, which might change the picture in an unpredictable way.

There are high-impact events scheduled today concerning both the GBP and the USD. Regarding the GBP, there will be a release of Current Account data at 9:30am London time. Later at 3pm there will be U.S. CB Consumer Confidence data.