EUR/USD Signal Update

Yesterday’s signals expired without being triggered as the price never reached 1.1218.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the first retest of the broken lower channel trend line currently sitting at around 1.1145.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

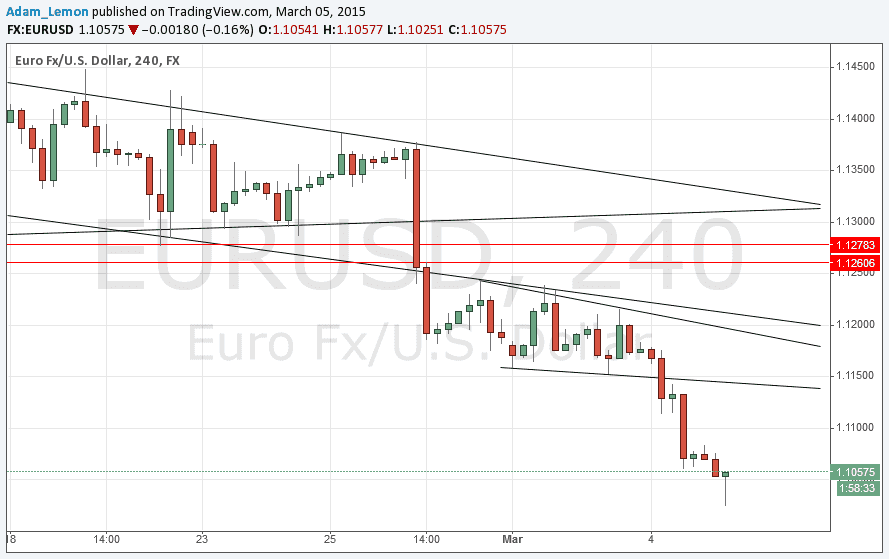

I forecast yesterday that the price was ready to break below 1.1150 and this is exactly what happened. The break was sudden and dramatic, and was followed by an equally sharp break below the whole number at 1.1100 later. The price continued to fall overnight, making new 13 year lows.

Technically we have had sharp break downs past two consecutive wedges. The picture looks extremely bearish but we are probably overdue for some kind of pull back.

Trading this pair short is the market’s “hot hand” and with the fall in GBP and recovery by CAD it is quite likely to remain so, as it will be in strong focus today and tomorrow.

The next best opportunity to get short again would likely be after a pull back to the broken lower trend line of the closest wedge. Currently this is fairly confluent with a flipped support to resistance zone close to the half-number at 1.1150.

There are high-impact events scheduled for both the EUR and the USD today. Regarding the EUR, there will be a release of the Minimum Bid Rate at 12:45pm London time followed by the ECB Press Conference at 1:30pm. Concerning the USD, there will be a release of Unemployment Claims data simultaneously at 1:30pm.