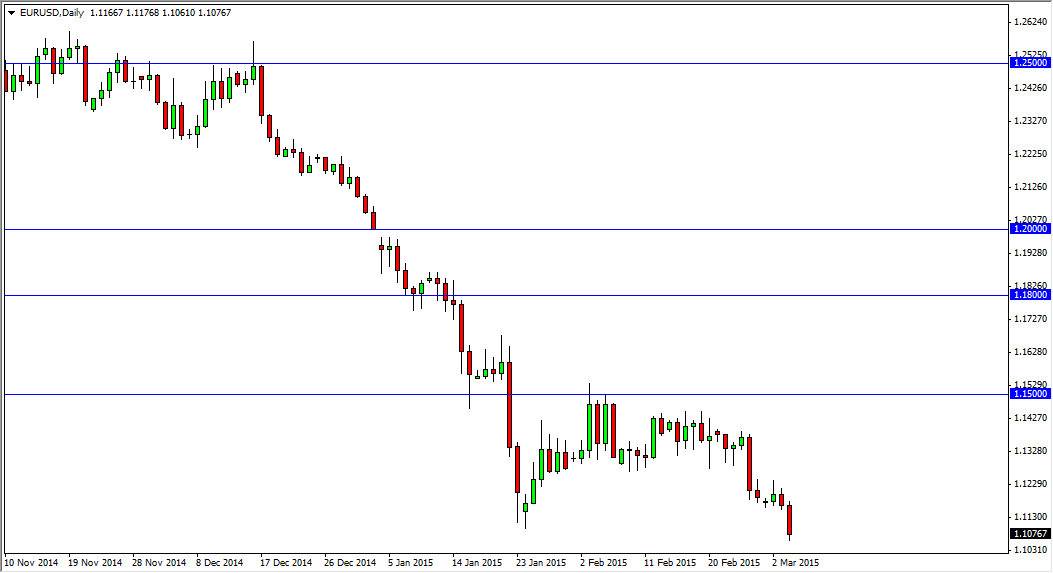

The EUR/USD pair broke down during the session on Wednesday, showing the market still has quite a bit of bearish pressure in it. Because of that, I feel that this market should continue to go lower, and that we are getting close to seeing the longer-term target of 1.10 hit. Because of this, I am selling rallies as they occur, as I expect the Euro to continue to soften overall. I also know that the US dollar is the favored currency around the world right now, and quite frankly I don’t have any interest in selling the US dollar against pretty much anything at this point in time.

I think that the 1.10 level will be massive in its application, and if we can break below there, we would more than likely head towards the parity level. I never thought I’d be able to say that, but here we are. I don’t really see any reason to think that the Euro is going to suddenly pick up strength, especially considering that the European Central Bank is stuck with potential deflation, and that almost always means loose monetary policy.

Continued downtrend.

I think that we continue to see a downtrend in this market, and that anytime the pair rallies, you have to look at it with major suspicion. You have to think of those moves as potential value in the US dollar, and as a result I have no interest whatsoever in buying this pair. I think that the 1.15 level above will continue to be massively resistive, and as a result it’s only a matter of time before the sellers will step in every time we do rise.

I think that the 1.10 level below will offer a bit of a bounce, if nothing else, just because of the psychological nature of the number. However, looking at the longer-term charts, you can still see quite a bit of support down there as well. With that, I think that the bounce from there will end up being a selling opportunity as well.