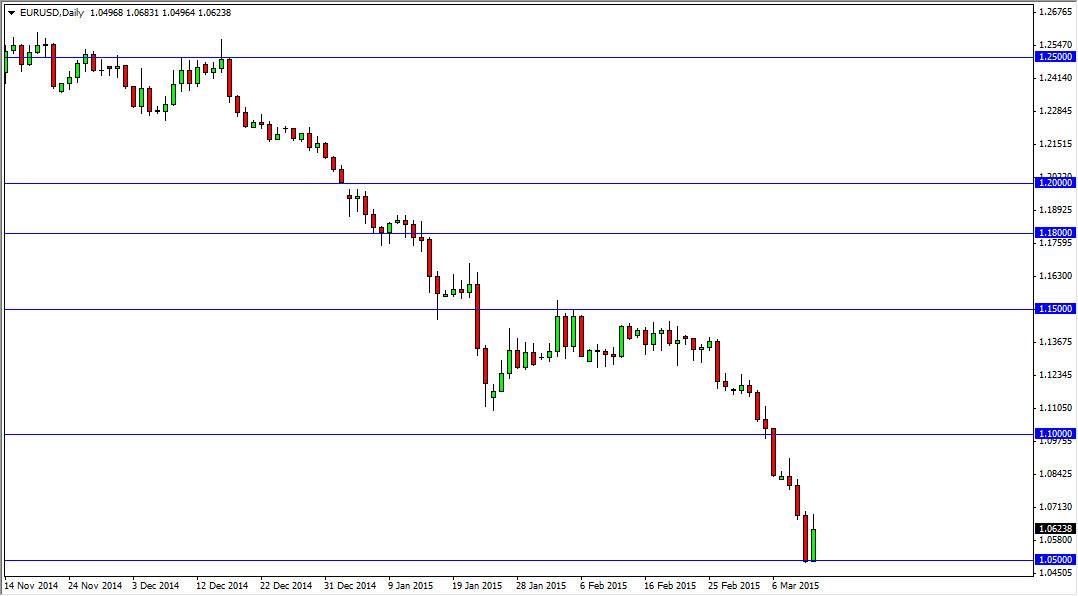

The EUR/USD pair bounced significantly during the session on Thursday, as the 1.05 level of course offered quite a bit of support. Because of this, the market looks as if it’s ready to put up a little bit of a fight, but ultimately I believe that the 1.05 level will in fact get broken down below. I think that the candle selling off a little bit towards the end of the day as we get close to the 1.07 level is a sign that we will of course continue to go much lower, and I think it’s only a matter time before the aforementioned break down actually happens. Remember, the Euro suffers on many different fronts, as deflation concerns are abound and on the forefront of trader’s minds as far as the European Union is concerned.

The US dollar is by far the favored currency by Forex traders, so I don’t have any interest in selling the dollar itself anyway. The Euro of course seems to have more troubles than any other currency, so it makes sense that this particular pair will continue to struggle. I think the 1.05 level is of course a large, round, psychologically significant number, but ultimately we will break down below there and head towards the parity level.

Continued downward pressure

I think that the downward pressure will certainly continue, but quite frankly this is a marketplace that a gotten a bit oversold. Because of that, the bounce really shouldn’t be much of a surprise. Ultimately though, I will look to the four hour charts for resistive candles in order to start selling again. I think that parity is almost a given at this point, and I think most traders are going to continue to push this market down until we get there. I don’t even have a scenario in which a willing to buy this pair right now, but we would have to at least break above the 1.10 level before I would even consider looking for a buying opportunity.