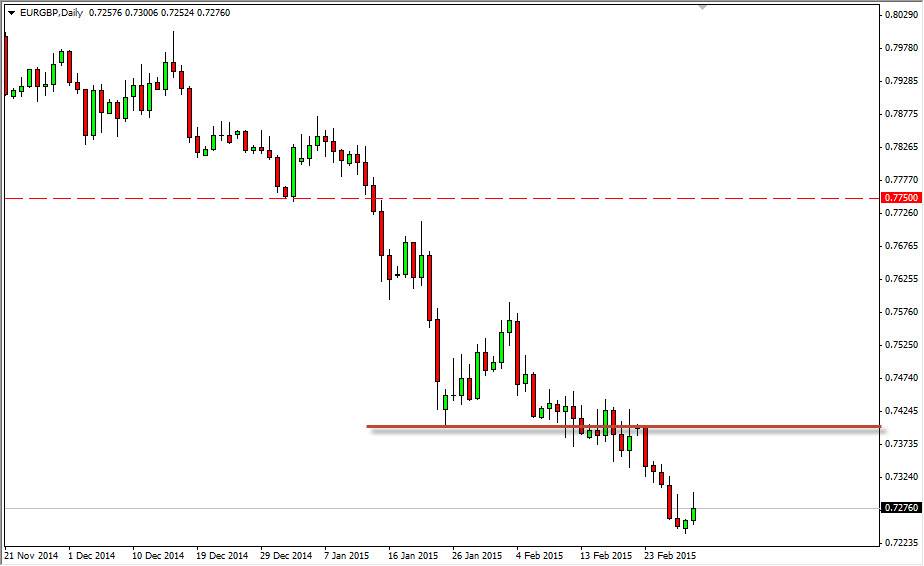

The EUR/GBP pair has been very steady for some time now, and as a result I have made a pretty decent profit shorting this market. I believe this will continue to be the case, as the Euro itself continues to struggle against most currencies. While the British pound isn’t necessarily going to explode to the upside, it’s not going to be the Euro and that’s really what matters. The shooting star during the session on Monday only reiterates the fact that the downward pressure continues. On top of that, we saw shooting star in the EUR/USD pair, which of course means that the Euro itself is struggling, and it’s not just this pair.

With that being the case, the fact that there is continued liquidity coming out of the European Central Bank suggests that we will see weakness going forward in the Euro. With deflationary concerns, money will continue to flow across the English Channel, as the money finds a much safer and friendly place to be.

Ultimately, we should head to the 0.70 level.

I believe that ultimately will head down to the 0.70 handle, which is a major support level on the longer-term charts. However, I think that the support extends all the way to the 0.71 level, so in other words this is going to be a bit of a grind down to that level. I believe this point in time we have already seen the easy money made shorting this pair, but we certainly cannot be bothered to buy it because of the massive bearishness.

Quite frankly, anytime this market starts to rally, I’m looking to sell as I do not trust those rallies. I believe that resistive candles offer selling opportunities on short-term charts, just as they do on the daily chart. Ultimately, I believe that this is a pair that should continue to offer more and more selling opportunities again and again. I have no interest whatsoever in buying this market and I see the 0.74 level to be significantly resistive.