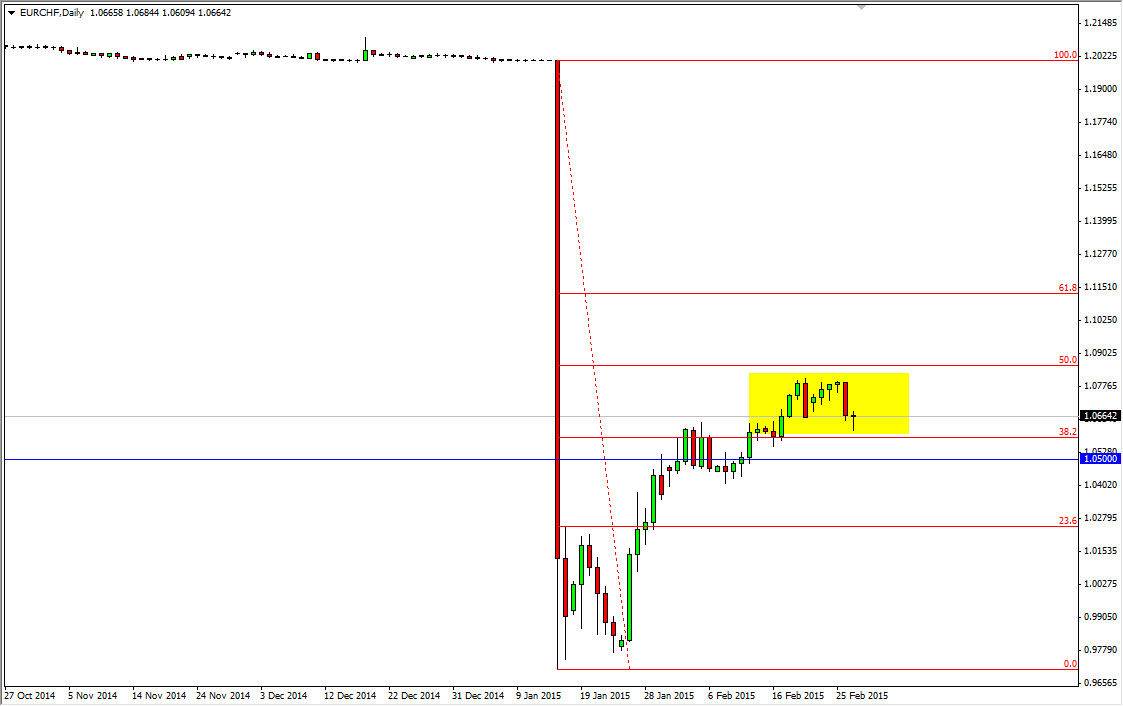

The EUR/CHF pair fell initially during the session on Friday, but as you can see bounced off of support at the 1.0650 level. By doing so, we ended up forming a hammer, which of course is a bullish sign. That bullish sign is a short-term trading opportunity as far as I can see, and if we break above the top of the hammer, we feel that this market should then go to the top of the consolidation area that we have been in recently, meaning that we should probably hit the 1.08 handle.

Looking at this chart, it is obviously in a downtrend, and at this point in time I have no interest in hanging onto this trade for any real length of time. That being the case, I feel that this is a short-term trading opportunity at best, but it is good for a few pips. On the other hand, there is the possibility that we break down.

Longer-term downtrend

I believe that the longer-term trend is most certainly to the downside, and as a result we break down below the bottom of a hammer I believe that we will continue to go lower. The whole region around the 1.05 level of course is going to be supportive, but at this point in time if you have a long enough time horizon it really doesn’t matter. After all, this is the epicenter of the action in the Swiss franc, and with that being the case, I feel that the market cannot be bought with any real conviction. With that being the case, I think that the position size you take on any move higher should be smaller than your usual position.

If we break down below the 1.04 level, we should then head to the 1.02 level, and then parity. I think this market continues to go to the downside though, simply because there are so many problems in the Euro. If we do break out to the upside with any significance, I just look at that as potential value in the Swiss franc and an opportunity to sell at higher levels. In the short-term though, this does look like a decent consolidation play.