EUR/USD Signal Update

Yesterday’s signals expired without being triggered during the London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm London time only.

Long Trade 1

• Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 1.0675.

• Put the stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

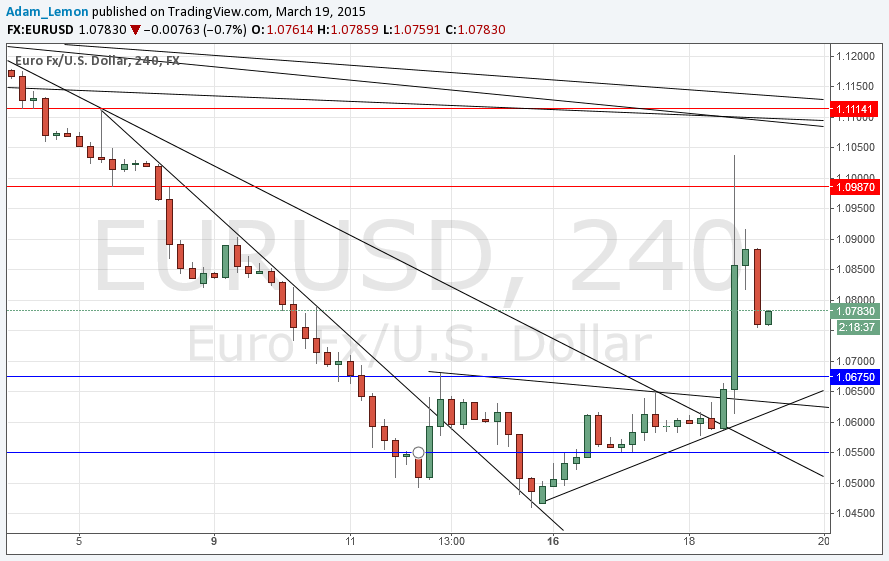

EUR/USD Analysis

I forecast yesterday that the next price movement was going to be heavily hinged to the fate of the USD. This was certainly the case, although the price was surprisingly bullish during the London session, breaking above recent highs and 1.0650 but never reaching our anticipated resistance level at 1.0675. That was just as well, as the US dollar bulls were left seriously exposed by the FOMC who painted a fairly downbeat picture for the USD. At one stage the price was trading above 1.1000. This is the largest move for a USD pair that I can remember seeing over just a few hours. The price has stabilised since and recovered considerably, but technical analysis is always difficult just after such strong moves, as our nearby resistance levels have been wiped out.

It is in the area below the current price that we can be most confident. The level at 1.0675 will probably now act as support, and we have both two broken bearish trend lines and a new bullish trend line that are nicely confluent with that level. Regarding resistance for short trades, it will be a while yet before that becomes clearer.

There are high-impact events scheduled today concerning both the EUR and the USD. At 10:15am London time the ECB will be releasing Targeted LTRO data. Later at 2pm there will be a release of Philly Fed Manufacturing Index data which may affect the USD. .