AUD/USD Signal Update

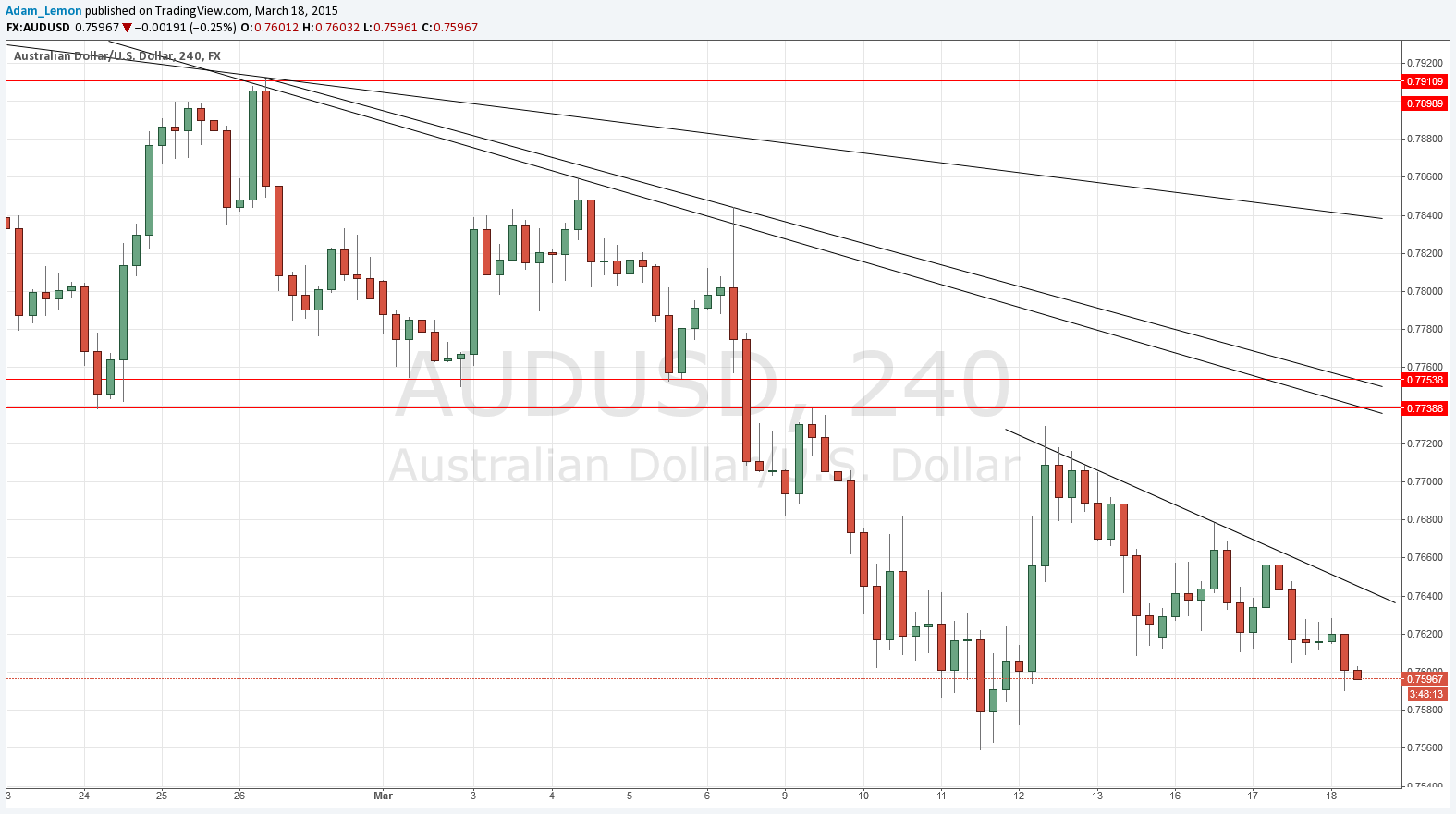

Last weeks’ signals expired without being triggered: unfortunately the price reversed just before reaching 0.7738.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

• Short entry following some bearish price action on the H1 time frame immediately upon the next test of the bearish trend line currently sitting at around 0.7640.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

• Short entry following some bearish price action on the H1 time frame immediately upon the first test of 0.7738 – 0.7754.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

This pair has been fairly quiet over the past week but looks positioned to break down strongly if positive USD news is released tonight by the Federal Reserve. The resistant zone will probably be too far away to provide a short entry today but the nearer, shorter-term trend line could.

There no high-impact events scheduled today concerning the AUD. At 6pm London time the U.S. Federal Reserve will be releasing the latest Federal Funds Rate and FOMC Statement and Projections. This will be very likely to have a heavy impact upon the USD.