USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made between 8am and 5pm London time today.

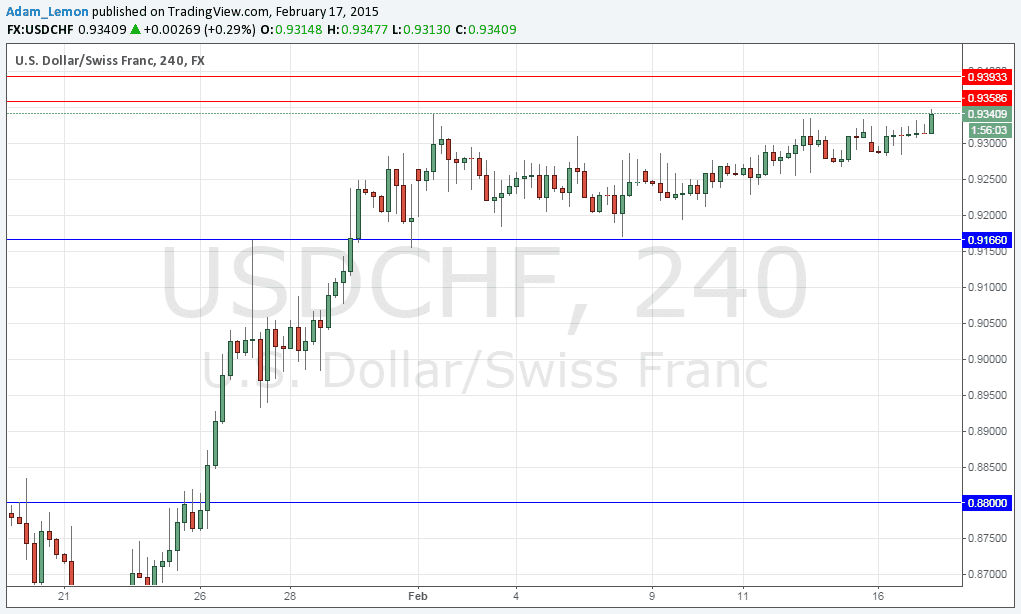

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.9166.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

the long-term consolidation within a fairly narrow channel continues for yet another day. The bias seems to b upwards, so it is likely we will hit resistance first, possibly giving us a chance to go short off a reversal. However there might be a breakout instead of a reversal after such a long consolidation.

At 5pm London time the Chair of the SNB will give a speech which could have effect the CHF. There are no events scheduled for the USD today but as yesterday was a public holiday in the USA it is quite likely there will be some appetite in the US market. However it is most likely to be a quiet day for this pair.