USD/CHF Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk only 0.50% per trade.

Trades may only be entered before 5pm London time today.

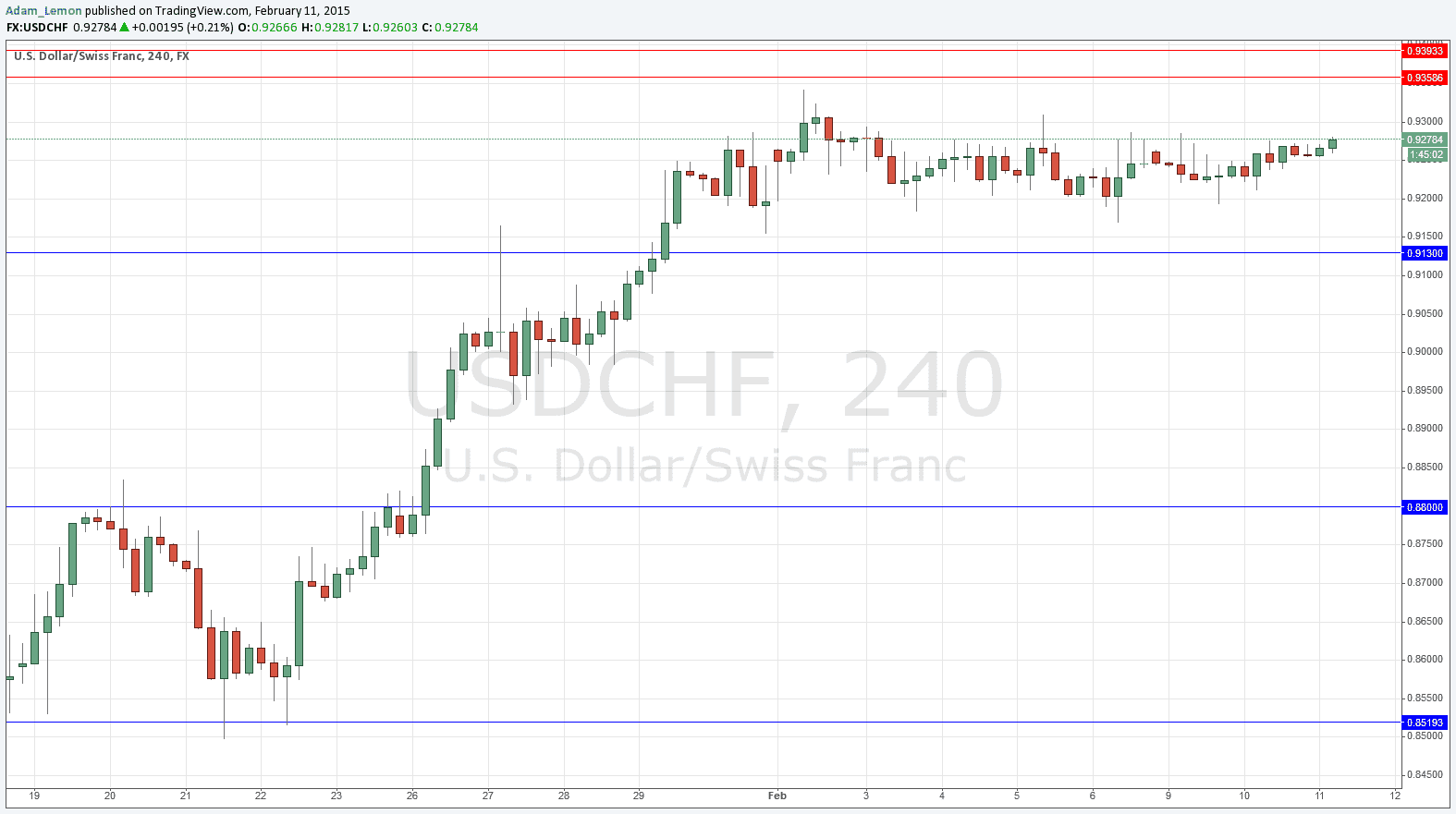

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9130.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This is a very strong, flat consolidation. This pair has hardly moved for an entire week. This should mean that the movement when it comes will be strong. Unfortunately this is complicated by the fact that we just had a period of excessive volatility in the CHF, so the consolidation might well continue for even longer.

There are no high-impact data releases scheduled for later today concerning either the CHF or the USD. Therefore it is likely to be a very quiet day for this pair, unless there is unforeseen news. If there are any dramatic developments emerging regarding the Euro, it might also move the CHF as a secondary effect.