USD/CHF Signal Update

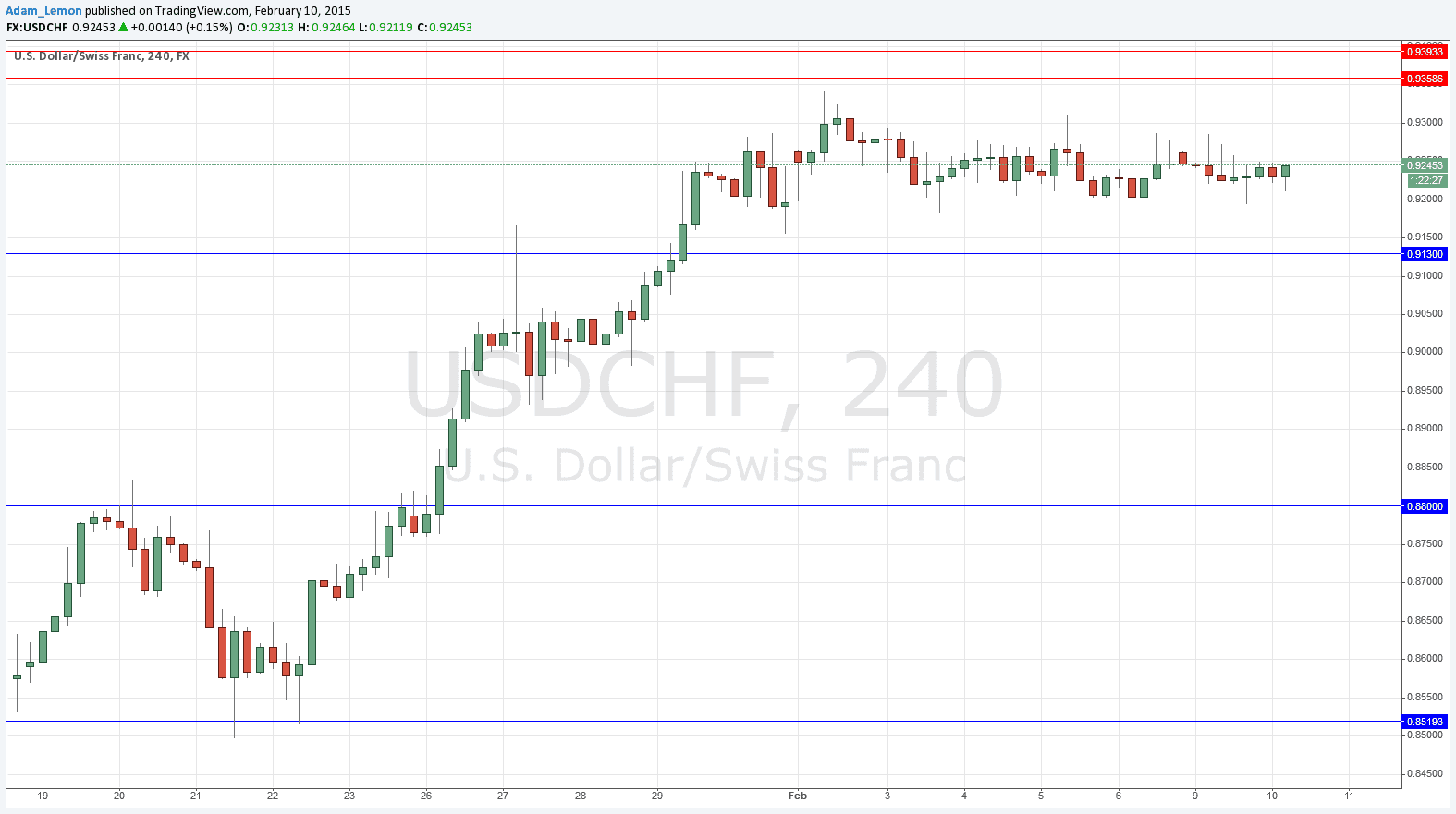

Yesterday’s signals were not triggered and expired as the price never reached either 0.9358 or 0.9130.

Today’s USD/CHF Signals

Risk only 0.50% per trade.

Trades may only be entered before 5pm London time today.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.9130.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The same dull consolidation continues, with ever-diminishing volatility. My colleague Christopher Lewis expects some strengthening of the CHF as we have reached the 50% Fibonacci retracement from the recent very strong and sharp move down.

There are no high-impact data releases scheduled for later today concerning either the CHF or the USD. Therefore it is likely to be a very quiet day for this pair, unless there is unforeseen news.