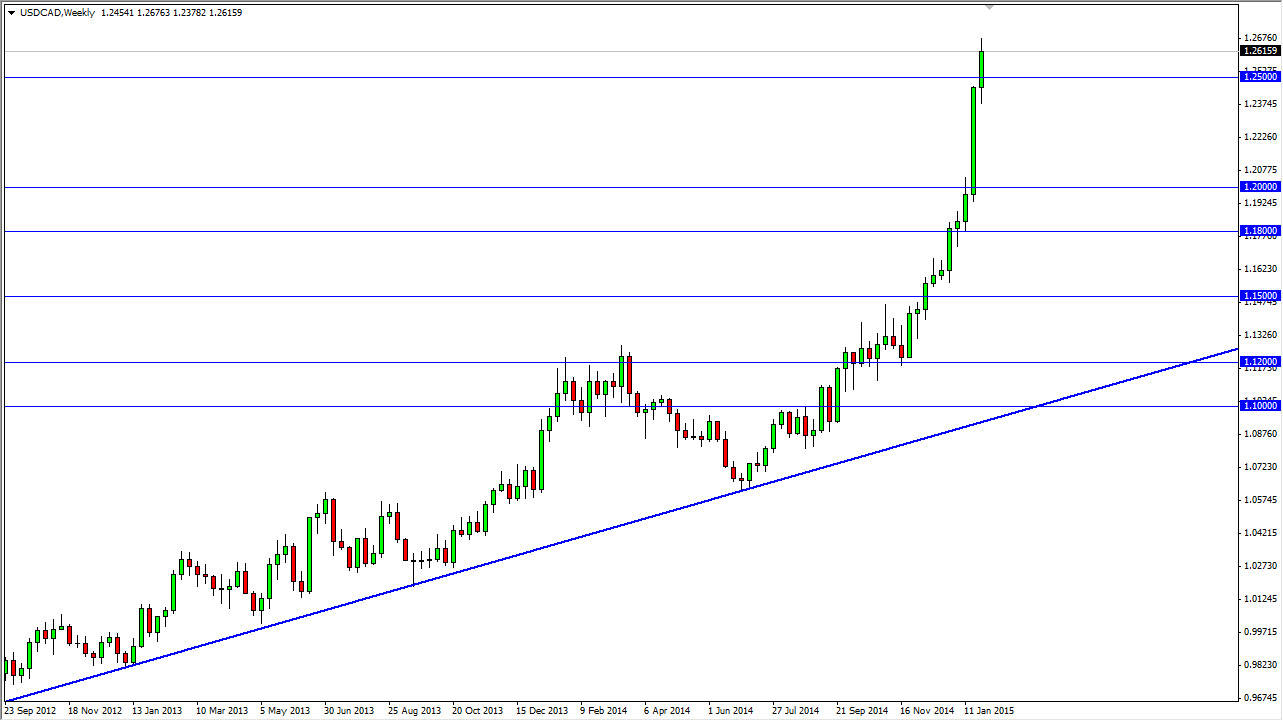

The USD/CAD pair broke higher during the course of January, and now is well above the 1.25 level at the time of writing. Because of this, I feel that this market will continue to go higher but a pullback would necessarily be the worst thing in the world. Quite frankly, this is a very impulsive move higher, and the last time we saw something like this was during the financial crisis. That of course is a strange coincidence when I realized that the next resistance barrier is at the 1.30 handle. That was exactly where the financial crisis driven spike higher stopped. In fact, that area was tested several times before finally holding as resistance.

Ultimately, I think we are going to reach the 1.30 handle given enough time, but a pullback is desperately needed. I think that February will still continue to be very strong for the US dollar while soft for the Canadian dollar, especially considering that the bank of Canada recently had cut rates in a bit of a surprise move.

Oil markets are not helping

The oil markets certainly are not helping either. After all, they look like they are set to go much lower. That of course will work against the value the Canadian dollar as it is so highly leveraged to petroleum, so I do not anticipate the Canadian dollar strengthening rapidly during the month of February. In fact, I think that any pullback at this point in time would have to be looked at with suspicion and as a potential value play in the US dollar.

The Canadians are very concerned about petroleum prices, and rightfully so. The Canadian dollar is essentially a proxy for the oil markets as far as Forex traders are concerned, and therefore it may get sold off regardless of what goes on in Canada itself. The interest-rate cut of course doesn’t help either, so right now I think we are in a bit of a perfect storm and that the 1.20 level is now the “floor” in this pair.