Gold prices settled slightly lower after shuffling between gains and losses, as investors took a cautious stance ahead of Fed chair's appearance before Congress. Federal Reserve Chair Janet Yellen is scheduled to deliver her semiannual report to lawmakers on the outlook for the U.S. economy. Her remarks could provide insight into when the U.S. central bank will begin raising interest rates. Gold has been on the back foot since late January on growing conviction the Federal Reserve is on course to hike rates as early as June.

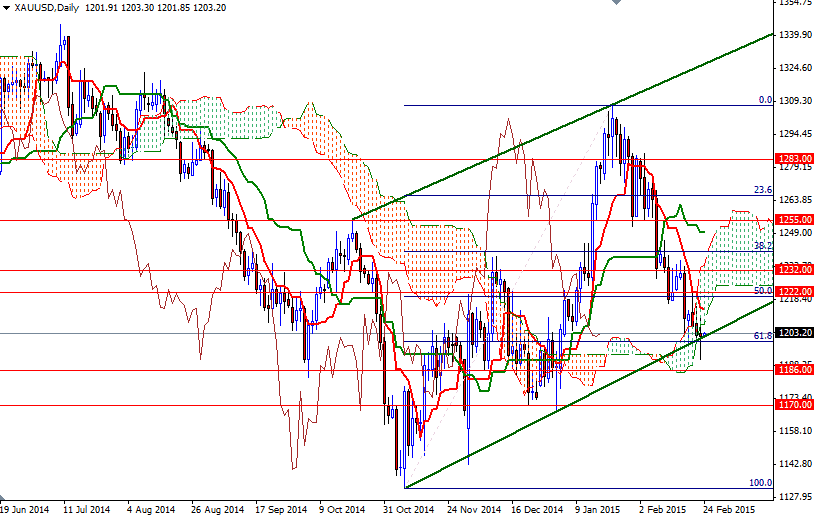

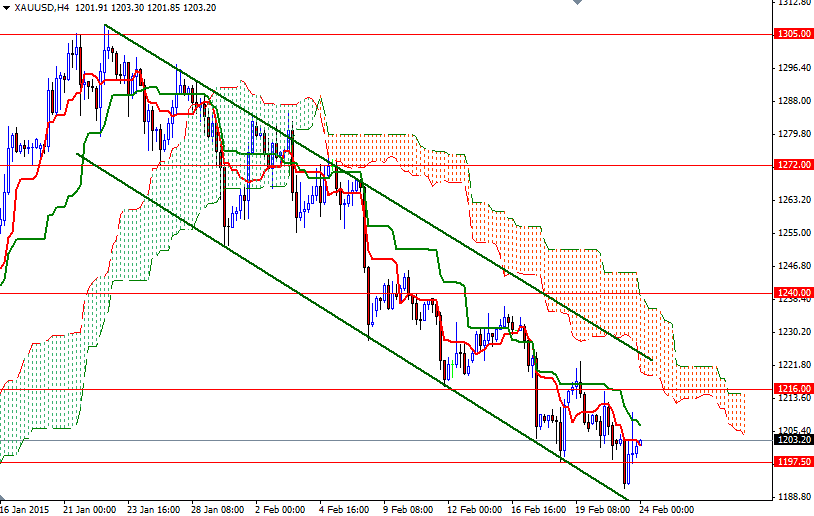

The XAU/USD pair dropped to its lowest level since January 6 at $1189.58 an ounce but erased some earlier losses after National Association of Realtors reported that sales of existing homes tumbled 4.9% in January. On the daily time frame, XAU/USD closed below the Ichimoku cloud yesterday, indicating that the bears are still in control. On the 4 hour chart, prices are below the Ichimoku cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned.

As I said in my previous analysis, the 1189/6 area is the key support for the bears to capture so that they can challenge the bulls at the 1170-1166 battle field. In order to revisit the 1189/6 region, they will need to push prices below 1197/5 again. On the other hand, if the market manages to hold above this initial support, we might see the XAU/USD pair heading towards the 1213.87 - 1216 resistance. Beyond that, the bears will be waiting at the 1222 level where the Ichimoku clouds on the 4-hour chart and the top of a short-term descending channel coincide. Closing above this resistance could signal a run up to 1232 or higher (1240).