GBP/USD Signals Update

Last Thursday’s signals were not triggered and expired.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of the nearest bullish trend line at around 1.5280.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 1

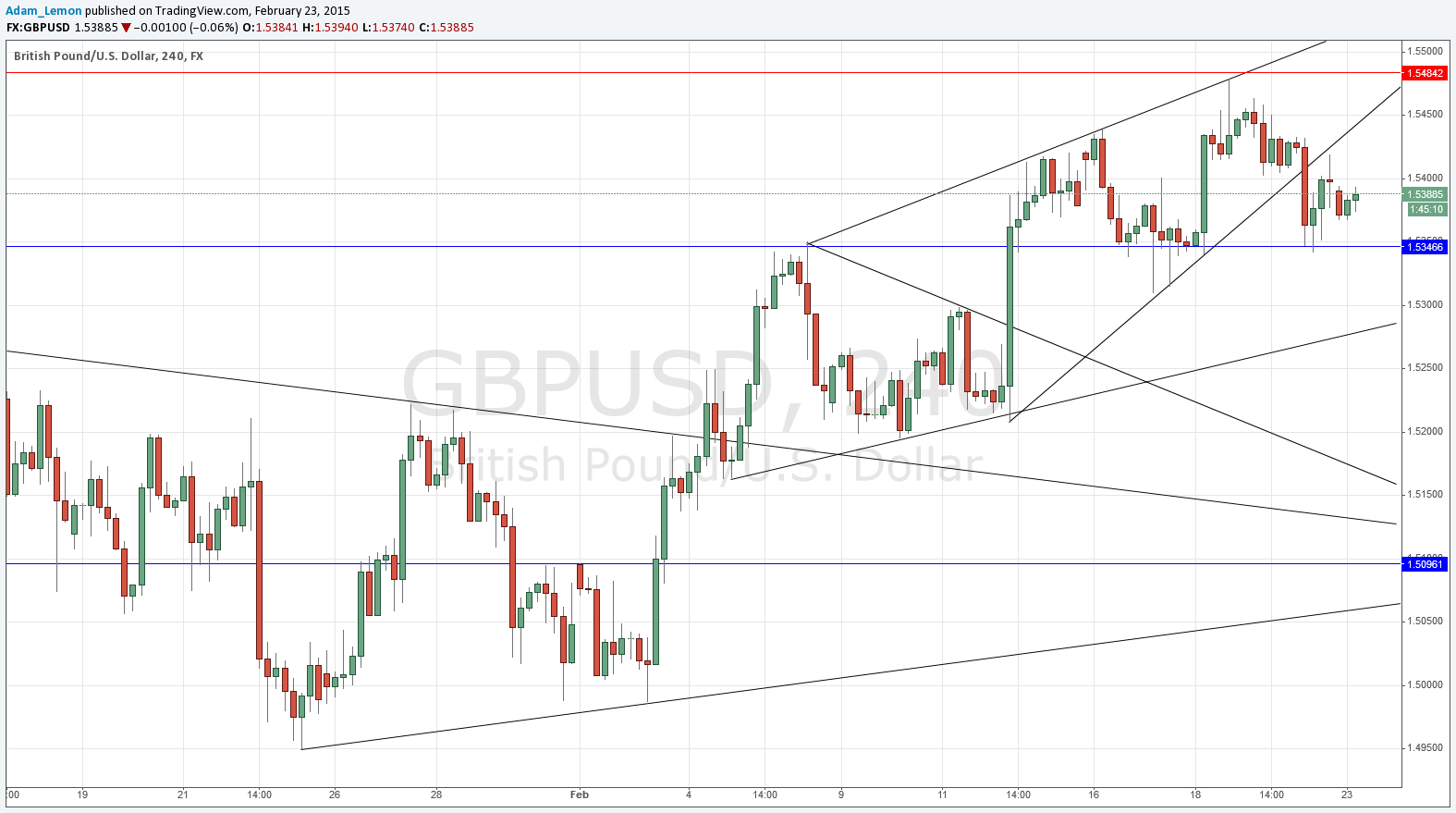

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.5482.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair remains bullish as the supportive area at around 1.5350 has held over recent days. However we did break down out of the bullish wedge last week, as I had expected following our very close support to what had been identified as strong resistance at 1.5482. We might need to break below 1.5350 and get down to 1.5280 before we are able to break up past 1.5482 – 1.5500.

There are no high-impact events scheduled for either the USD or the GBP today. It is likely to be a relatively quiet day for this pair.