GBP/USD Signals Update

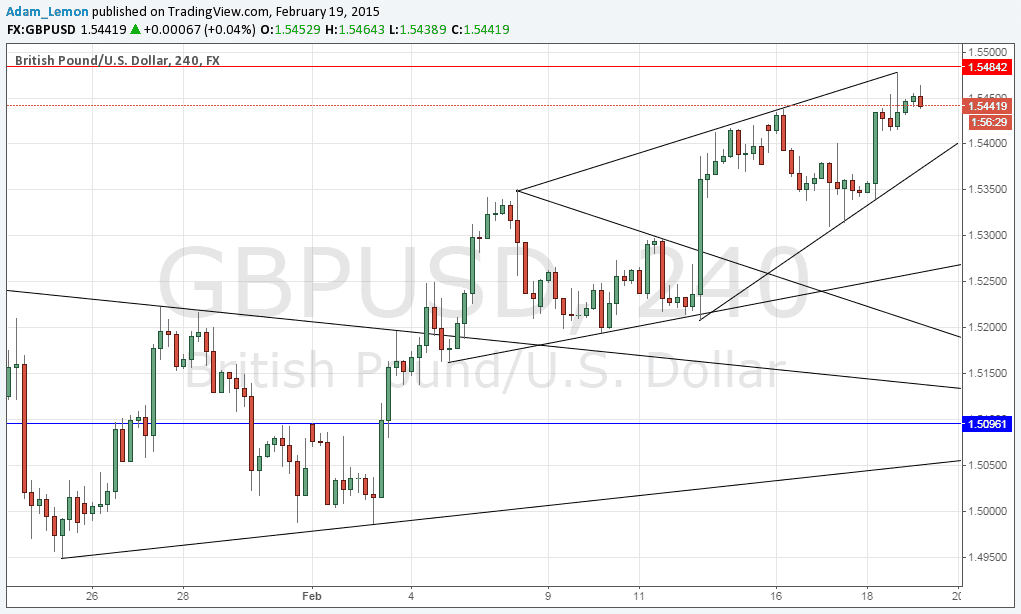

Yesterday’s signals expired without being triggered as the price never reached either 1.5250 or 1.5482.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of the second-nearest bullish trend line at arund 1.5260.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.5482.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair made two moves up yesterday following firstly positive GBP data followed later by a dovish FOMC report that sent the USD down. Therefore the bullish trend continues and the GBP is looking like the only true “strong” currency, with the possible exception of the USD. It might be that the GBP will take over the strongest currency role from the USD and in that case we culd see this pair rise a lot further.

Despite this bullishness, we may be somewhat over-extended in our move up, as we now approach an area with some resistance confluence. If we touch 15482 and print a reversal pattern, we should expect the price to fall considerably.

I am not giving the closest bullish trend line as a signal for that reason.

There are no high-impact events scheduled for the GBP today. Regarding the USD, at 1:30pm there will be a release of US Unemployment Data followed by the Philly Fed Manufacturing Index at 3pm.