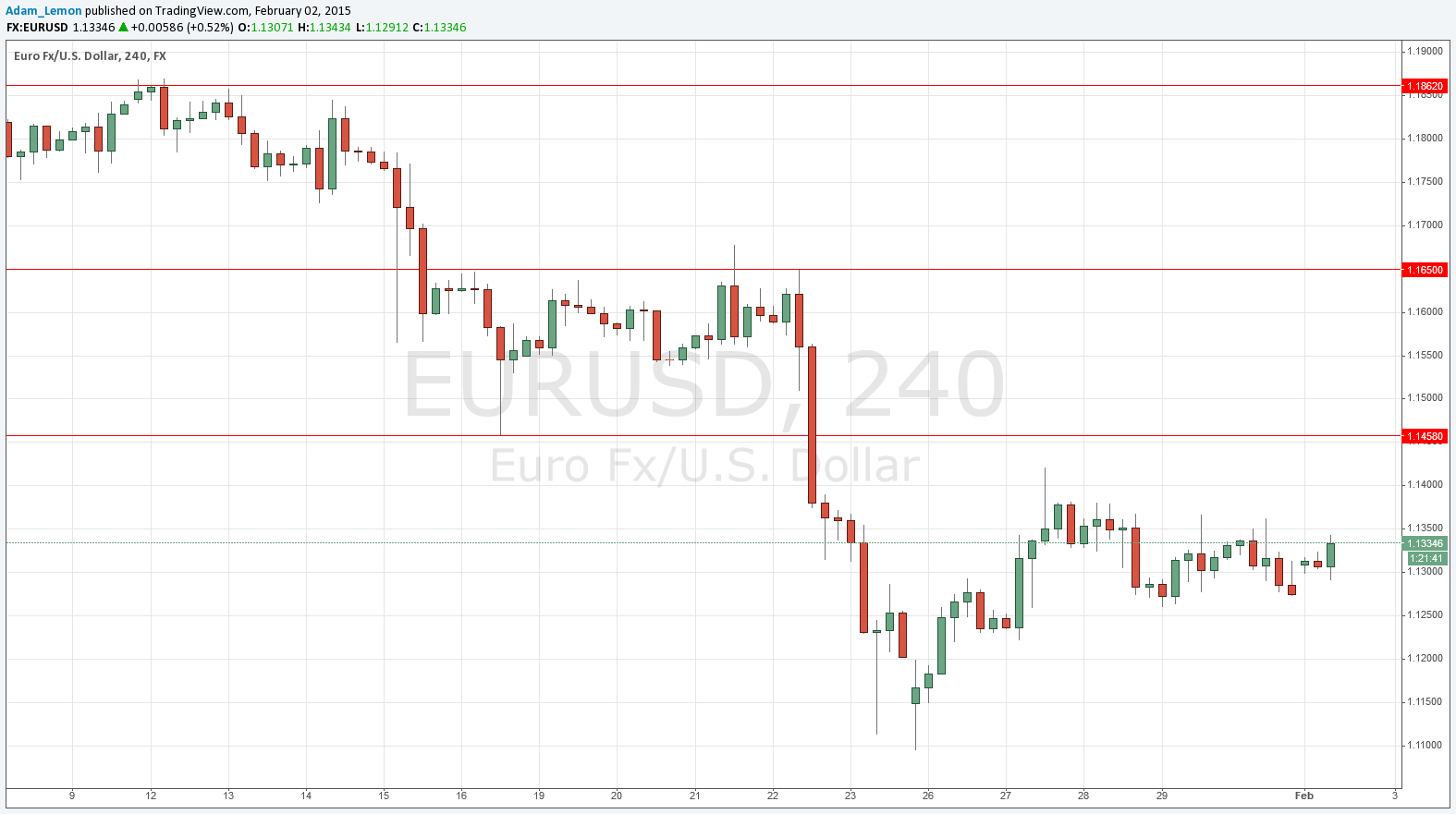

EUR/USD Signal Update

Last Thursday’s signal expired without being triggered as the price never reached 1.1458.

Today’s EUR/USD Signals

Risk 0.75%

Entries can only be taken before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1458.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Last Thursday I saw that minor support might have been located at 1.1250 and this proved to be the case, with the low of the day falling just a few pips above that level. Since then the price has been moving up slowly, with the EUR bullishness holding, even if it is a little suppressed.

The EUR has along with the CAD been one of the most consistently weak currencies of recent weeks. The ECB’s program of QE that was announced a few days ago did initially dramatically weaken the Euro, but it has since recovered from its recent 11 year low just below 1.1100.

The long-term trend plus fundamentals are all aligned for this pair to fall again, but of course it could be that 1.1100 was the turning point. Only time will tell for sure.

There are no really good support or resistance levels anywhere nearby with the exception of 1.1458 which should prove to be resistant. There may be more minor resistance at 1.1421 and also the support I previously mentioned at around 1.1250.

There are high-impact data releases scheduled later today concerning the USD. At 3pm London time, there will be a release of U.S. ISM Manufacturing PMI data.