EUR/USD Signal Update

Yesterday's signal expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time only.

Short Trade 1

Short entry following some bearish price action on the H1 time frame immediately upon the first touch of 1.1532.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 1

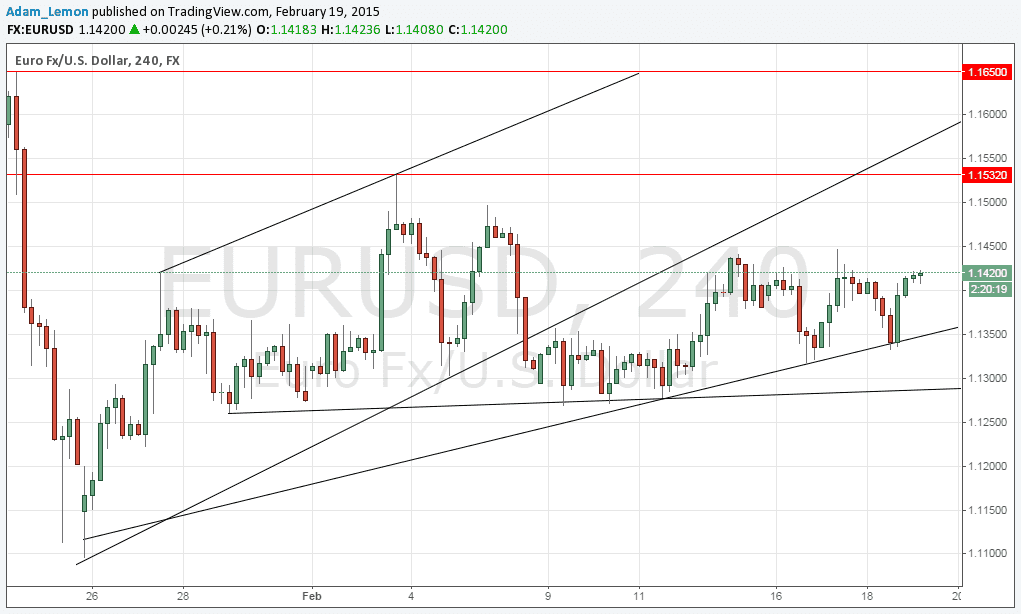

A very short-term long scalp off any reversal at the bullish trend line shown in the chart below. The trend line is currently sitting just below 1.1350.

EUR/USD Analysis

Yesterday the price did relatively little before the FOMC release, although it did fall from a high above 1.1400 down to a low of 1.1332 at one point. Here it met a bullish trendline that was becoming established just at the point that the FOMC minutes were released which were somewhat bearish for the USD. The price broke up past the short-term bearish trend line. Therefore the technical picture now is realtively bullish, but there is plenty of resistance above 1.1450. Like my colleague Christopher Lewis I expect the area at 1.1500 to be resistance, especially the level at 1.1532. A short trade is possible from a reversal there. In the shorter-term, the bullish trend line can be used for a quick scalp, as I am doubtful that this line is going to be vert strongly reliable.

There are high-impact events scheduled for both the EUR and the USD today. Regarding the EUR, at 12:30pm London time there will be a release of the ECB Monetary Policy Meeting Accounts, as the ECB finally begins issuing the minutes of the ECB Governing Board Meetings. At 1:30pm there will be a release of US Unemployment Data followed by the Philly Fed Manufacturing Index at 3pm. Therefore it is likely to be a relatively lively day for this pair.