EUR/USD Signal Update

Yesterday’s signals expired without being triggered as although the price did reach 1.1350 there was no bullish price action.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

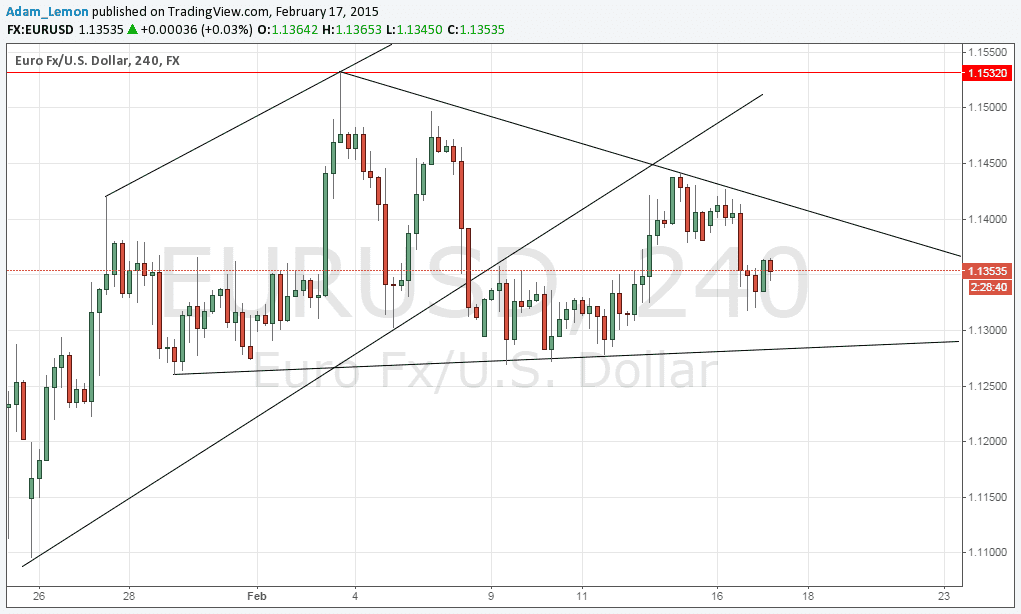

Short entry following some bearish price action on the H1 time frame immediately upon the first touch of 1.1532.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

Yesterday the market was expecting to a strong degree the announcement of a deal between Greece and the rest of the EU that would put the Greek crisis to rest or at least kick the problem into touch for several months. Instead, what the market got was the total absence of a deal, and statements from both parties indicating that neither was prepared to climb down far enough to meet the other side's red lines. This initial caused the Euro to fall slightly when the situation became apparent, but since then it has recovered to make up some of the small ground it lost.

Technically, we have lost 1.1350 as a level, and the only reliable horizontal level anywhere nearby looks to be 1.1532. We are becoming established within a consolidating triangle but I am reluctant to lose this as its trend lines do not feel as if they are going to be of high quality.

At 10am London time there will be a release of ZEW German Economic Sentiment data which is likely to have an impact upon the Euro. There are no events scheduled for the USD today but as yesterday was a public holiday in the USA it is quite likely there will be an appetite in the US market, leading to a day with some healthy volatility for this pair.