AUD/USD Signal Update

There are no outstanding signals.

AUD/USD Analysis

This pair usually tends to trend fairly dramatically, in fact it has produced some of the best momentum trend trading performance results of any USD currency pair over the past decade.

Although the AUD is also a “commodity currency” as Australia is a significant gold producer, and the value of the AUD/USD has been quite highly positively correlated with the price of Gold in USD terms, this correlation has become less relevant recently.

Over recent months, this pair has been trending strongly, with the AUD decreasing steadily in value over the past 2 years by more than 25% against the USD. The trend has been particularly strong in recent weeks, but has been falling off over recent days. Trend traders are waiting to see whether the strongly bullish USD trend that has dominated the Forex market since the summer of 2014 is going resume.

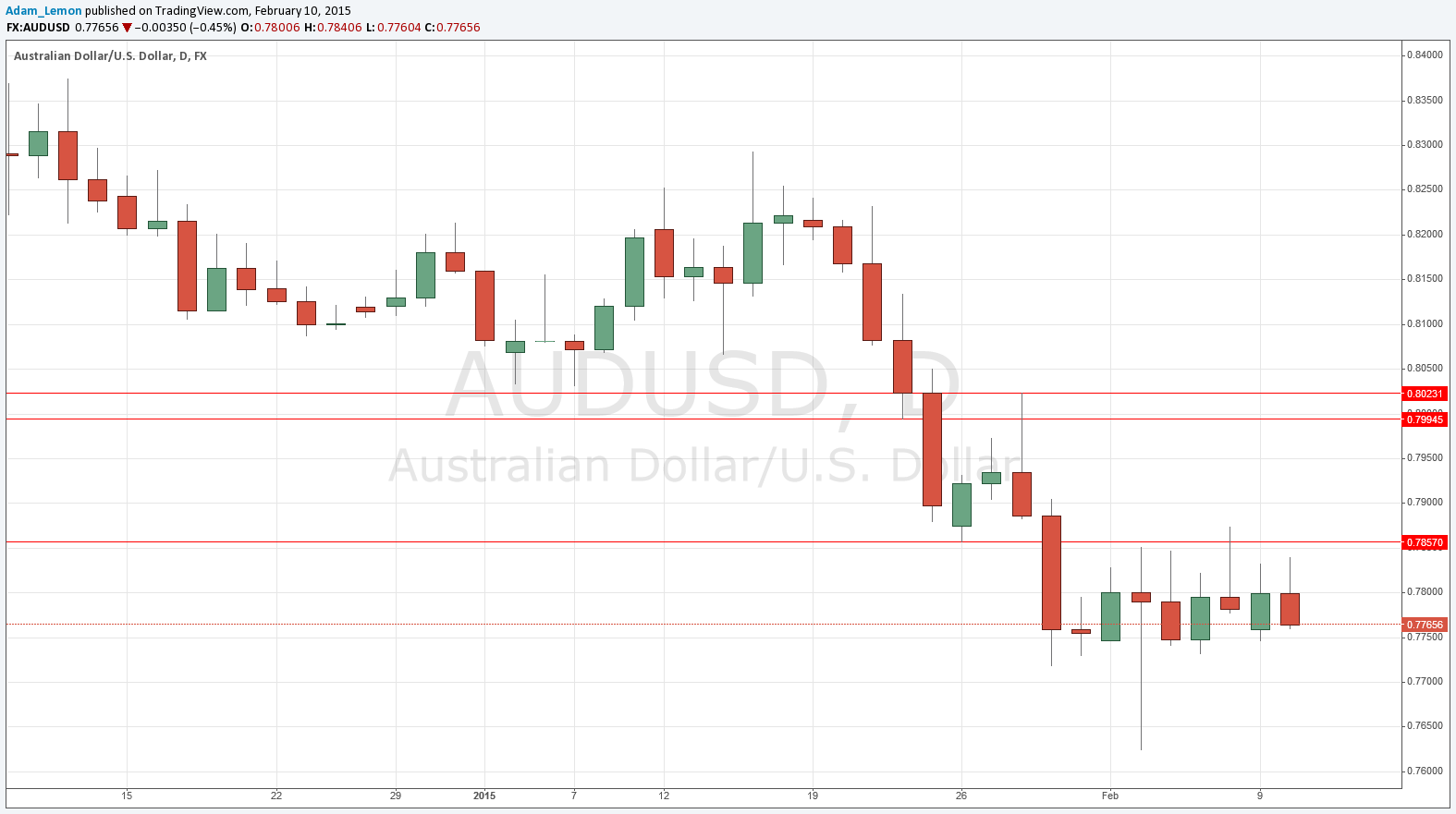

We have a strong demand zone above confluent with a key psychological round number at 0.8000. The zone stretches from 0.7994 to 0.8023 and was formed by a nicely strong bearish outside candle that was retesting an original supply zone in the same area.

Although we did get a recent bounce up that looked quite strong, with the bullish pin candle a few days ago, it has not followed through. We have instead several upper wicks suggesting a failure to break above 0.7857 which looks to have been formed as a flipped supportive level that has now become resistance. The day before yesterday was a bearish pin candle and we seem to be in the process of forming a bearish engulfing or even outside candle today.

Overall, this pair looks nicely poised to drop further, and this drop could be happening any time now.