USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 117.75.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 121.00.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

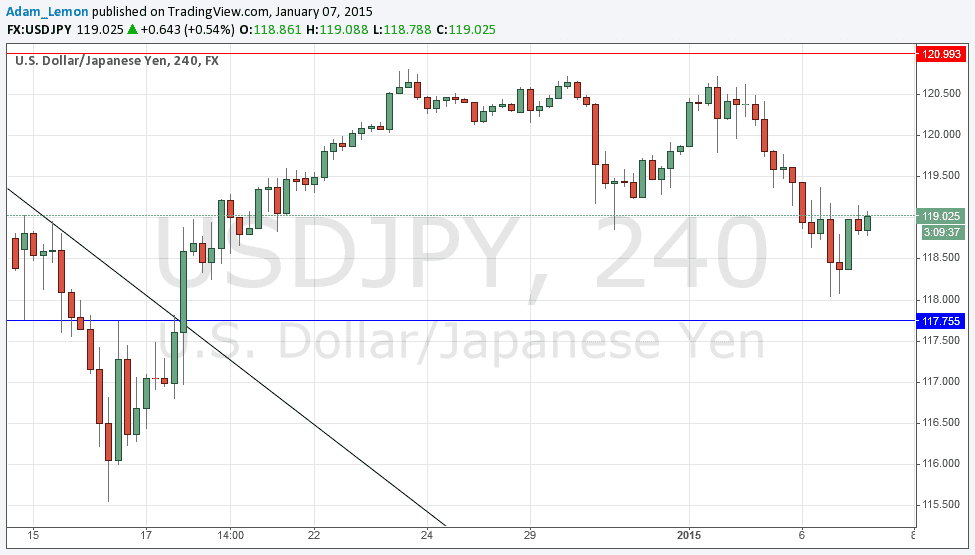

USD/JPY Analysis

There is big USD news due this evening and later this week, so it might be hard to get into any good trades that stick today, unless you are fortunate enough to be positioned on the right side before a directional move that might begin tonight with the FOMC release.

This pair is still going sideways but the JPY has been strengthening somewhat, which drive this pair's price down fairly close to the anticipated support at 117.75, since when it has been turning upwards. The support might have kicked in early so it is possible today's London session will see some kind of upwards move.

There are no significant changes and we are still in between the same key levels as yesterday.

There are high-impact data releases scheduled today concerning the USD only. At 1:15pm London time there will be a release of ADP Non-Farm Employment data. Then at 7pm there will be the U.S. FOMC Meeting Minutes.