USD/JPY Signal Update

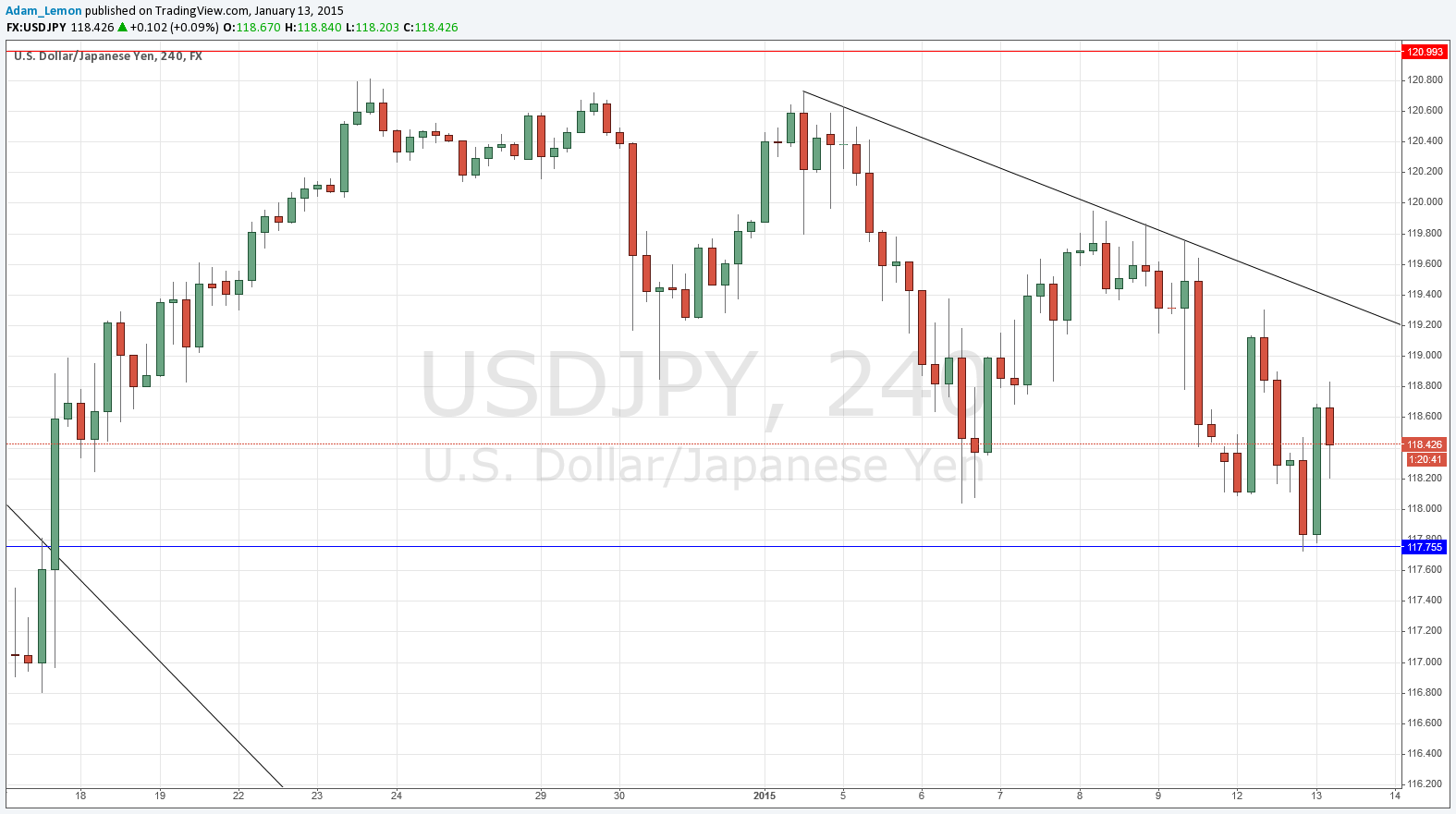

Yesterday’s long signal to look for a trade following a bounce off 117.75 may have been taken, as there was a bullish three-candle pattern. If so, the trade would still be live. I would look for the next exit to be made at the next touch of the bearish trend line shown on the chart below.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches the bearish trend line shown above the current price in the chart below.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I wrote yesterday that we are probably looking at a narrowing triangle situation. Even though the bottom did not hold, as expected the 117.75 level proved to be supportive, and almost to the pip. So the price rose after that level was hit earlier during the Tokyo session. The bearish trend line should continue to act as natural resistance for a while longer at least, in the absence of any major news. If the price gets there today, it should hold as resistance, perhaps giving an opportunity for a short trade.

My colleague Christopher Lewis disagrees, he is not interested in trading any short-term bearish moves in this pair.

There are no high-impact data releases scheduled today concerning either the JPY or the USD. It is likely to be a relatively quiet day today for this currency pair.