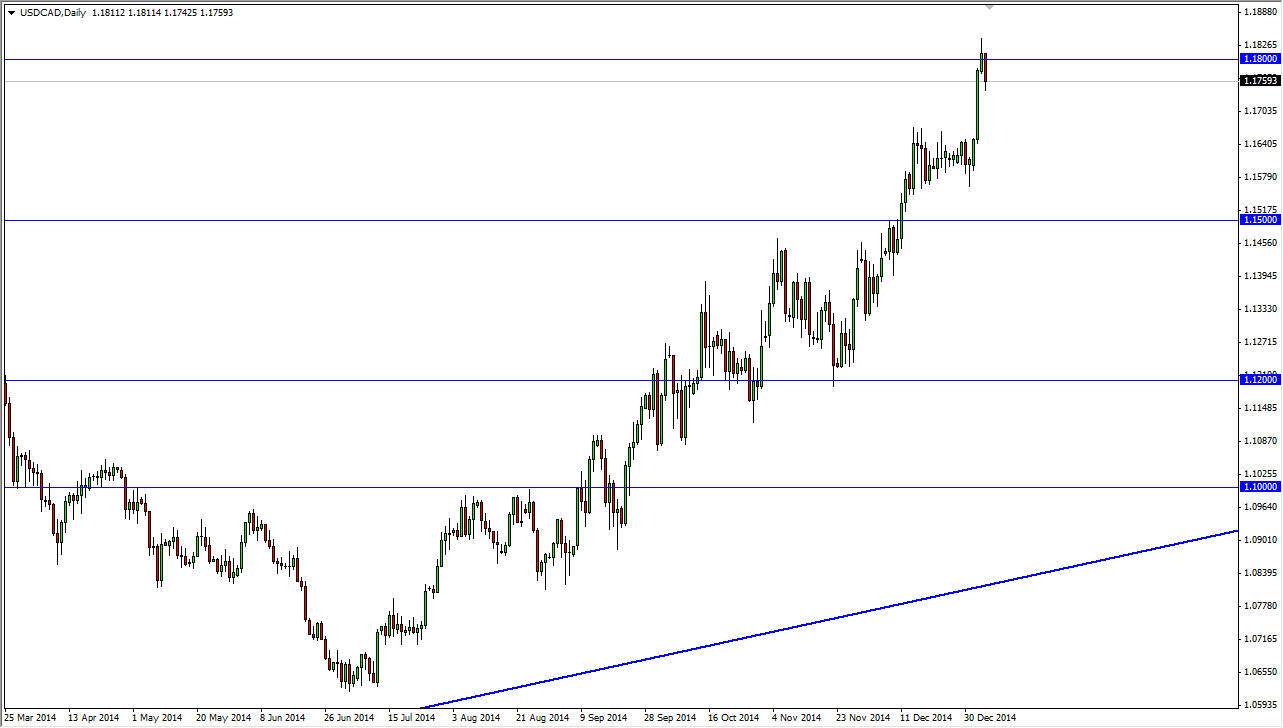

The USD/CAD pair pulled back from the 1.18 level during Monday trading, which isn’t much of a surprise to me as I saw the area of significant resistance. Now that we have had this pullback, I believe that we may drift a little bit lower to coincide with the oil markets. After all, the light sweet crude market hit the $50 level during the session which of course is a massive large, round, psychologically significant number. Because of this, I would anticipate the oil markets to bounce slightly, just as this market will more than likely pullback.

Remember, the Canadian dollar is highly sensitive to the price of oil, so the fact that oil rises should push the value the Canadian dollar higher. However, there will be a lot of crosscurrents this week and the fact that we will still have fairly light volume should continue to play havoc with the way this pair behaves.

Friday should be important

I think that the next day or two will more than likely be a bit soft in this pair. However, by the time we get the Friday will be truly interesting as both economies be measured via the jobs numbers. This normally moves this pair drastically, and as a result I would be apt to think that any pullback at this point time be seen as value, and that the buyers will step in. I also believe that the 1.15 level is the “floor” in the market at the moment, but truthfully I would be surprised to see this pair break down below the 1.16 level for any significant amount time.

The US dollar continues to be the favored currency around the world, and that of course will continue to be the case at least for the time being. It’s a bit difficult to imagine that a commodity influenced currencies such as the Canadian dollar will suddenly strengthen with any great gusto or that the trend will change. However, you need to be cognizant of the fact that the 1.18 level is in fact a major level overall. Because of that, I believe that this pullback will be a bit of a momentum building exercise in order to break out to the upside.