Gold prices rallied Thursday to log their highest settlement in four months after prices got a boost from the SNB's decision to abandon its cap of 1.20 franc per euro. The U-turn, which also saw interest rates cut deeper into negative territory, increased desire for safe haven diversification and helped provide a lift to gold. Softer-than-expected U.S. economic data also increased attractiveness of gold as an alternative investment. The Philadelphia Fed’s manufacturing index came in weaker than expected with a print of 6.3 in January, down from the previous month's 24.5 and below expectations for a reading of 20.3. Separate reports from the Labor Department showed the number of first-time applicants for jobless benefits rose 19K to 316K and the wholesale price index fell 0.3%.

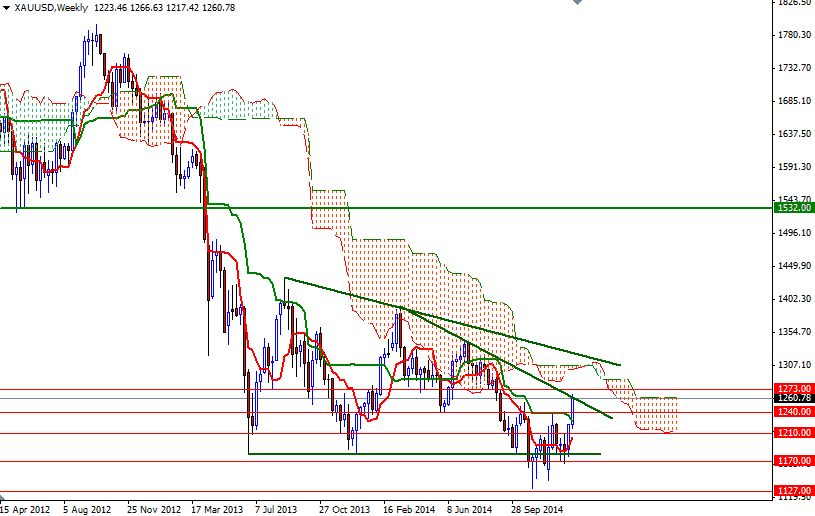

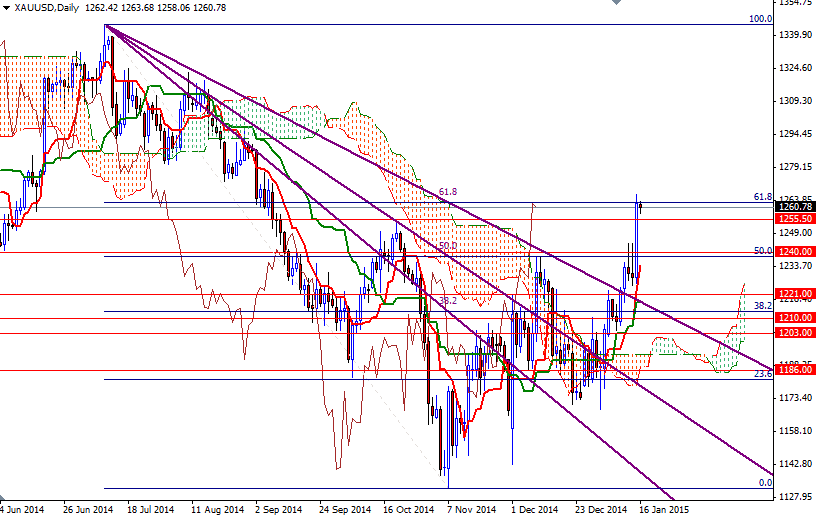

The XAU/USD pair accelerated its advance after penetrating the $1240 resistance level and traded as high as $1266.63. From a technical point of view, the daily and 4-hour charts will remain bullish while the pair is trading beyond the Ichimoku clouds and the Tenkan-Sen line (nine-period moving average, red line) is moving above the Kijun-Sen line (twenty six-day moving average, green line). Recent price action makes me think that prices will have a tendency to rise towards the weekly cloud.

However, I will keep an eye on the 1263/6 resistance area. Since some forms of resistance (the shorter term descending trend-line and 61.8% Fibonacci retracement) line up together in that area, I believe it will be a tough nut to crack. If the market climbs and hold above that area, it is likely that we will test the 1273 level afterwards. On the other hand, if profit taking starts to weigh on the market, we will probably pull back the 1255/2 area. Below that, expect to see support at 1248 and 1240.