Gold prices settled higher on Friday after the most recent data from the United States showed that gains in employment haven't been enough to lead in to wage pressure, fueling speculation that the Federal Reserve will not be in a hurry to alter the monetary policy. According to the Labor Department's report, non-farm payrolls increased by 252K in December after an revised 353K gain in the prior month and the jobless rate fell 0.2% to 5.6%. However, data also revealed that average hourly earnings dropped 0.2%.

The precious metal got extra lift from declines in the U.S equity markets and dovish comments from top Federal Reserve officials. Federal Reserve Bank of Chicago President Charles Evans said "We shouldn't be raising rates before 2016... I just don't see why we should be in a hurry to move off our current accommodative policy. we ought to be confident that we are going to get inflation up to our 2% level. we ought to see wages growing in the 3% to 4% range". Federal Reserve Bank of Atlanta President Dennis Lockhart said "All the wage measures remain well below historical norms, and I think I would have to say they are not consistent yet with particularly tight labor markets".

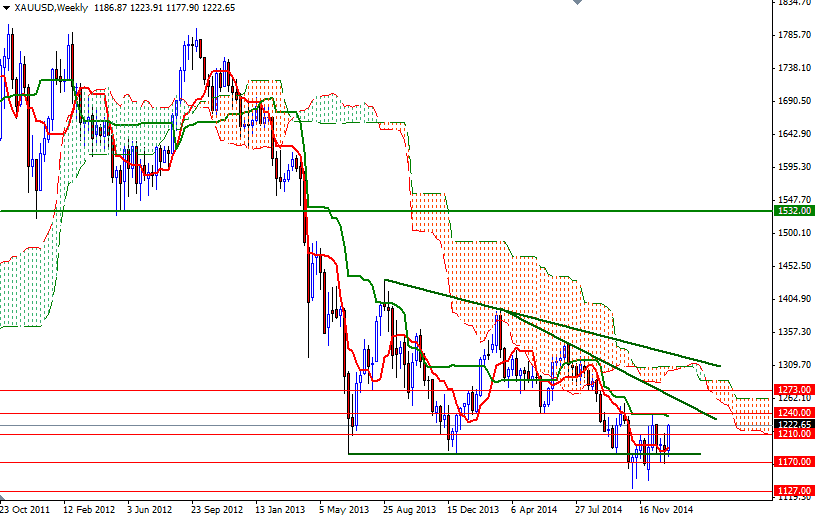

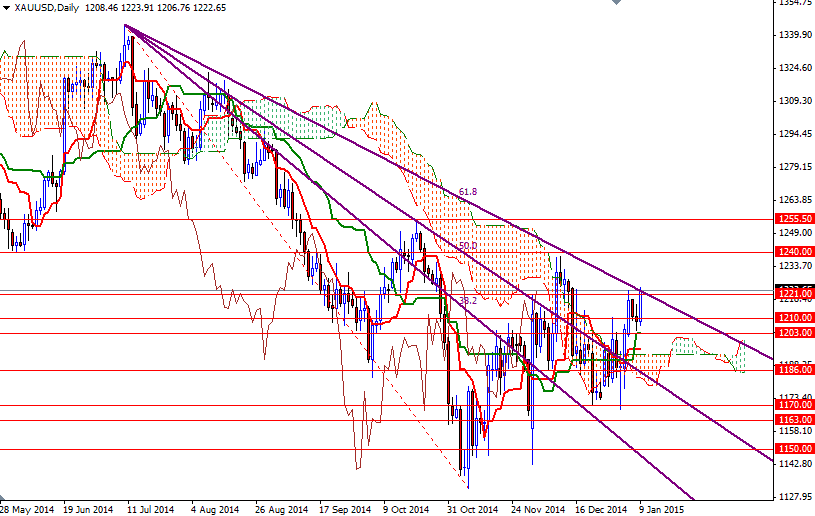

While some investors feel solid improvements in the U.S. economy will give the Fed the confidence to start normalizing policy, others think that low inflation and weak wage growth give the Fed room to keep interest rates near zero to bolster further progress in the labor market. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 122178 contracts, from 115837 a week earlier. Since last Monday, I have been telling that the odds were favoring higher prices - the second bounce off the support at 1170 had indicated a strong buying interest. Speaking strictly based on the charts, I expect technical picture to remain positive as long as the market trades above the Ichimoku clouds. That means, the bulls will have to defend their important camps at 1203 and 1193.54 going forward. If the XAU/USD pair closes back below 1193.54, the bears will be targeting 1186 and 1180.22 (1179.20). In order to head towards the 1240/35 area, the bulls will have to clear the interim resistance at 1227.30.