EUR/USD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s EUR/USD Signals

No signal is given today.

EUR/USD Analysis

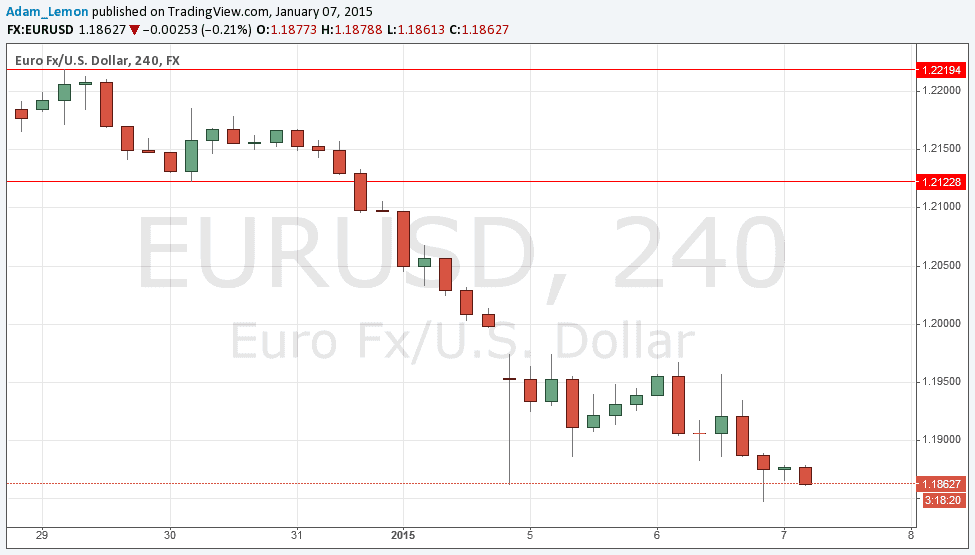

The price fell yesterday before bouncing back during the early part of the New York session. However, it has now fallen again overnight, during which time it made a new low that has not been seen in almost ten years. The anticipted support at 1.1875 has not proved to be very supportive and therefore has been removed from our chart.

The four hour chart below shows there are no real obvious inflection points above us at which to look for resistance at pull backs, except the weekend gap which can be dangerous to use as support or resistance. The closest such level is found at 1.2122 which is more than 250 pips above the current price.

As for supportive levels, the general area around 1.1800 is broadly seen as supportive in the market, but these levels are unclear and were last seen so long ago that it is extremely hard to determine likely levels at which the price might turn long.

Looking at the schedule, we have NFP on Friday and FOMC minutes tonight, both of which can be crucial for the USD. Therefore it is quite possible there will be low liquidity during the day today, leading to unreliable and probably inconsequential moves.

For all these reasons, there are no signals given for today's London session.

There are a high-impact data releases scheduled today concerning both the EUR and the USD. At 10am London time, there will be a release of Eurozone CPI Flash Estimate data. Later at 1:15pm there will be a release of ADP Non-Farm Employment data. Then at 7pm there will be the U.S. FOMC Meeting Minutes.