EUR/USD Signal Update

There are no outstanding signals.

Today’s EUR/USD Signals

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.1893.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

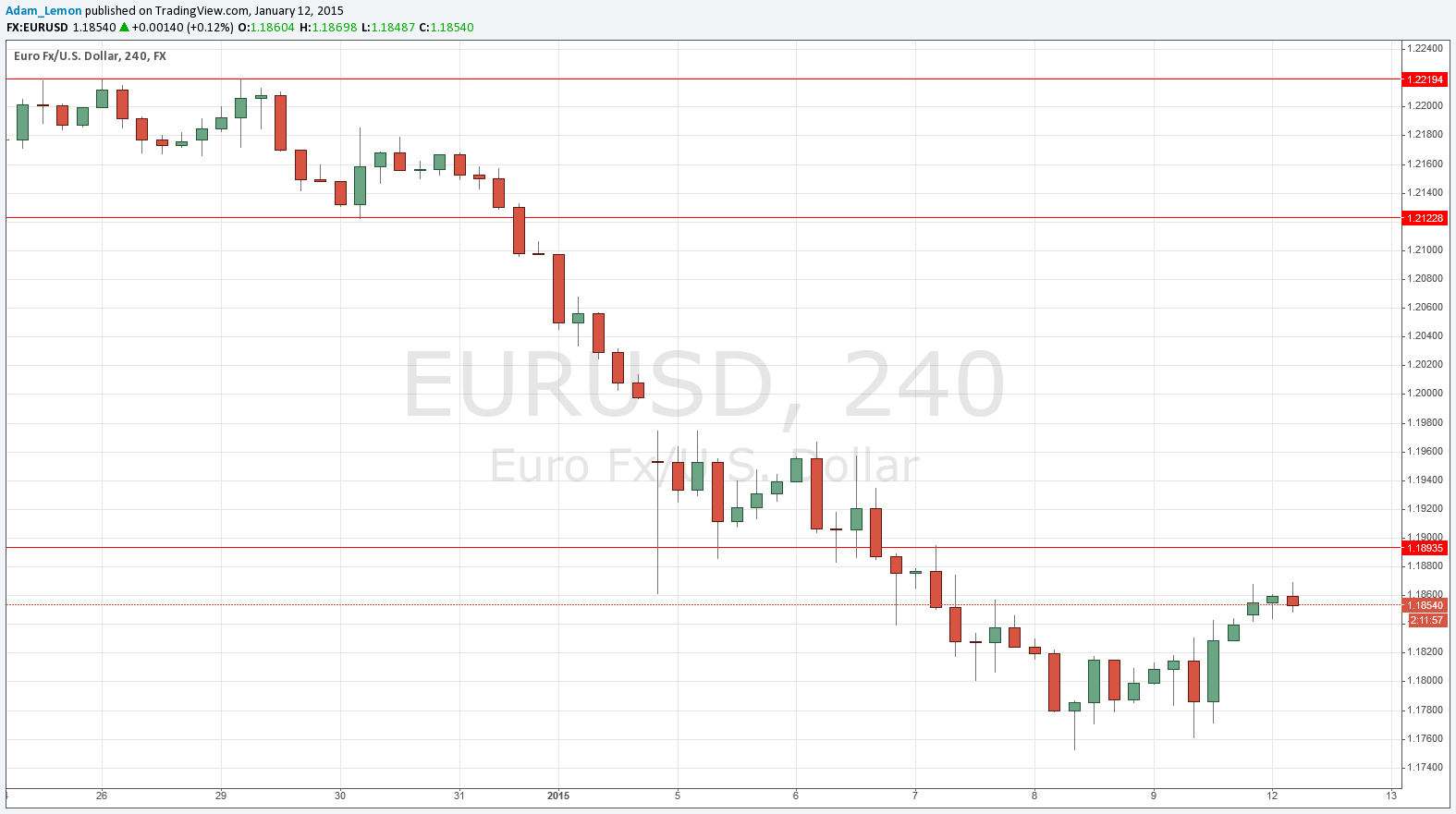

My most recent analysis last week concluded that it was really hard to determine what is going to happen next with this pair, as we have reached historically supportive levels, but remain in a strong, long-term downwards trend. Moreover, these historically supportive levels were reached nine years ago, and there is no level that really sticks out.

Having said that, the 1.1750 level would seem a psychologically rational place for any support to kick in, so it is not surprising this happened in the second half of last week, with the price rising about one hundred pips from a low of 1.1753. My colleague Christopher Lewis sees these levels as a good bargain price to get long, as the 1.18 level is holding so far.

I am reluctant to trade against such a strong trend, and I actually see a flipped support to resistance level not far above the current price at 1.1893. Should the price reach this level today, it should be a good opportunity to look for a short trade.

There are no high-impact data releases scheduled today concerning either the EUR or the USD. It is likely to be a relatively quiet day today for this currency pair.