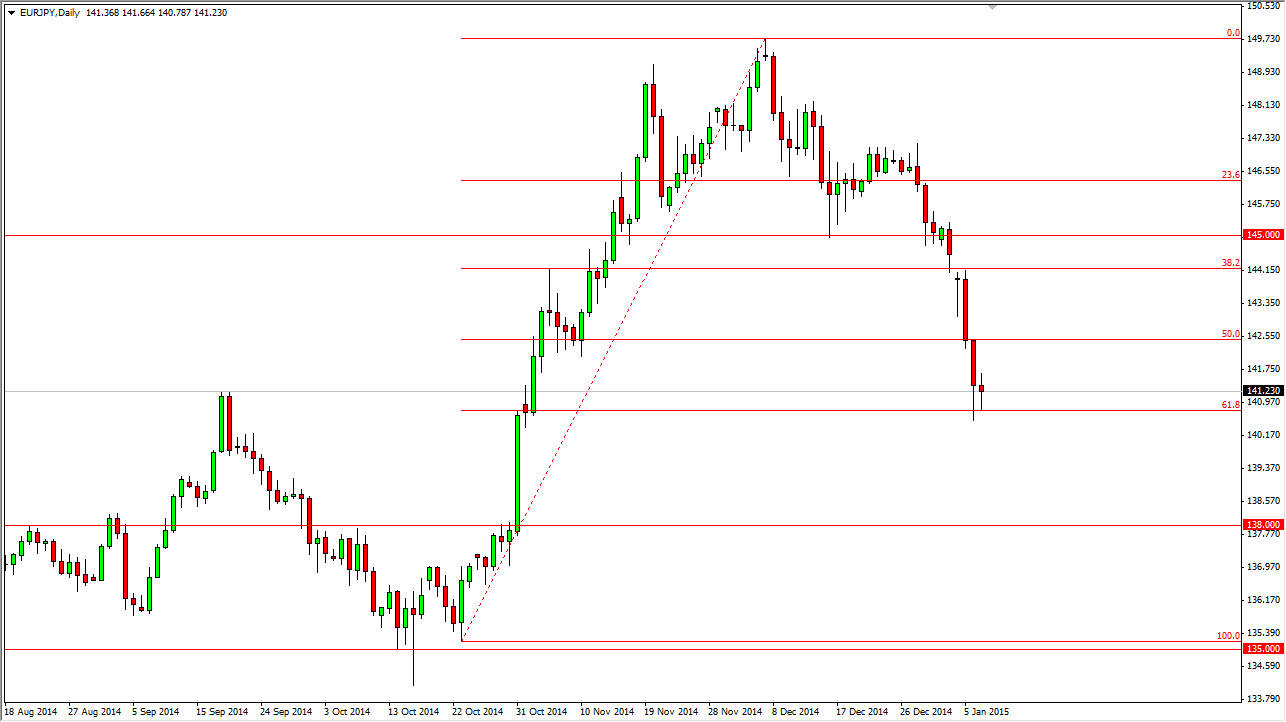

The EUR/JPY pair initially fell during the course of the day on Wednesday, but as you can see found enough support just below the 141 handle to bounce and form a little bit of a hammer. Also adding credence to the idea of support is the fact that this area was previous resistance during the month of September, and of course as you can see his the 61.8% Fibonacci retracement level.

Longer-term, the Japanese yen is going to lose value, so I think a lot of people were out there looking for value. Adding credence to the idea of a move higher is the fact that the EUR/USD pair stopped at the vital 1.18 level today, showing support at an area that it absolutely must. In other words, the Euro might bounce anyways, so that would only lead this pair higher.

Longer-term uptrend is still in play

I believe that the longer-term uptrend is most certainly still in play, as the market has pulled back but not exactly meltdown. Keep in mind that the market is paying attention to the Japanese yen more than the Euro, but if we do in fact find support in the EUR/USD pair, that just gives is yet another reason to start thinking about buying. Keep in mind that this market is also highly sensitive to the nonfarm payroll, not necessarily because of the two currencies involved directly, but the fact that the USD/JPY pair as. That of course has a bit of a “knock on effect” in this market, and that can push things much higher.

We ultimately believe that this market will continue the uptrend and head towards the 150 level, but recognize it is going to take quite a bit of effort, and obviously quite a bit of pullbacks from time to time. With that, we feel that the market will ultimately be one that you can buy on dips, but recognize that it might be a bit erratic between here and the aforementioned 150 target