The AUD/SGD pair isn’t one that most to be traded very often, but it is a nice play on Asia. After all, the Singapore dollar is more or less a play on the banking system in Asia, while the Australian dollar of course is a plan on commodities. In other words, is Asia strong? Right now, banking in Asia seems to be a safer bet than gold markets out of Australia.

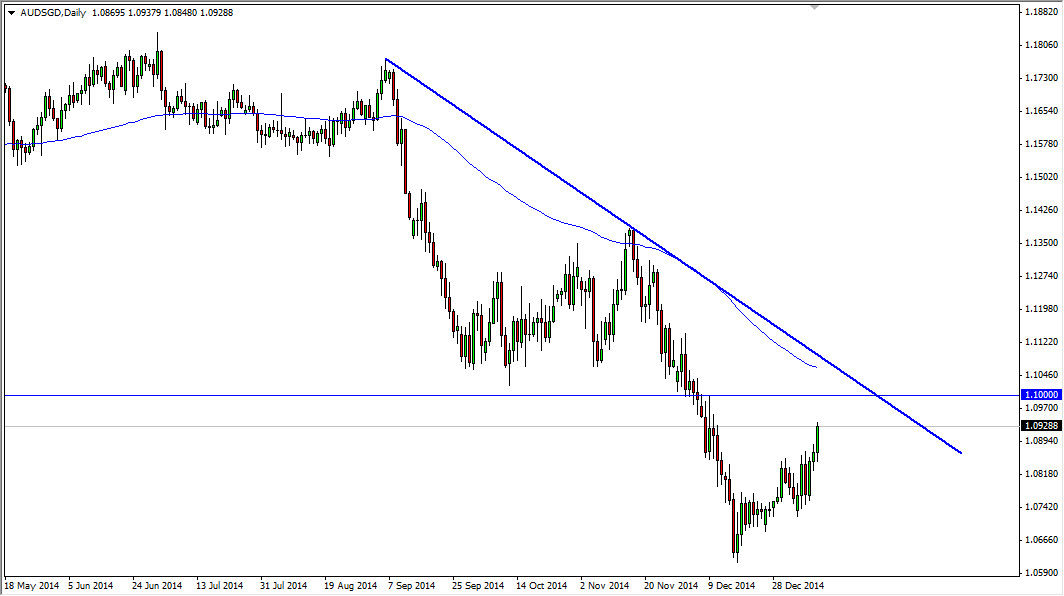

With all that being said, when you look at this chart you can see that we broke higher during the session on Friday. However, we are coming up on three things that I am paying attention to: the 1.10 handle, as it is a large, round, psychologically significant number and was also massive support previously. The next thing of course is the 100 day exponential moving average, as you can see is heading towards that same level, and then of course the big trend line that I have drawn on the chart. In other words, there are plenty of reasons the think of this market could turn back around in that general vicinity.

Sometimes we get paid to wait

Although this does look like a market that’s probably go little bit higher in the short-term, I am simply waiting for some type of resistant candle close to the 1.10 level in order to turn things back around and start selling off again. Ultimately, I believe that it’s only a matter of time before we see the selloff, so being patient is what you have to do. If you can get that right resistive candle, you can get a move all the way back down to the 1.05 handle given enough time.

I know that this isn’t a pair that must be trade, but the spread is pretty reasonable. Most the time is 20 be in the neighborhood of about five pips, so not too bad. I believe that the downtrend does in fact continue, and as a result I am very interested in the next couple of sessions as far as what happens in this market.