By: Stephanie Brown

Liberty Teller, the MassChallenge startup that opened four Bitcoin ATM machines around the Boston area, has rebranded itself into LibertyX and will now allow users to purchase the digital currency around 2,500 locations in 33 states across the country. LibertyX’s founder says that it include 60 locations around Massachusetts and 9 locations around the Boston area. The startup is now branding itself as a financial services company and has recently partnered with various merchants around the country in order to expand its demographics and reach a wider number of users.

Industry experts believe that the step taken by the company is a positive one and with introducing Bitcoin ATMs’ it will be far easier crypto-currency consumers to access.

In other news, financial services company Bitreserve has created a new gold standard, linking its Bitcoin currency exchange and payment services with gold. The company believes that this is the latest step towards making Bitcoin more mainstream. It will enable users to hold their money in the currency they believe is the most stable and convert it into Bitcoin in order to conduct transactions, thus providing their clientele an added layer of security, and hedging against volatility in the Bitcoin markets.

Technical Analysis

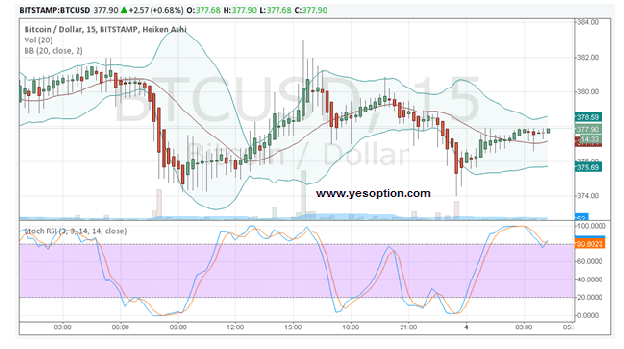

The BTC/USD continues to face resistance near $384. Every time it moves above $380 there is heavy selling pressure, which causes it to fall beneath $380. When looking at the chart, it has resistance at $378.59 and support at $377. Its Stochastic RSI indicator is at 80.80 and is moving up, indicating a buy signal. However, caution is heavily advised.

Actionable Insight

Sell the BTC/USD below $376.5 for target of $373, $368, with a stop-loss of $378.5.